The stock market is a funny ol’ place.

Think about it.

Two people can have completely different perspectives — and both may be right.

Let’s use an example in Xero Limited (ASX: XRO), the accounting software company.

Me: “I think Xero is a fast-growth company, worth owning for 5 years.”

Another investor: “I think Xero is overvalued because it doesn’t make a profit, and therefore its shares will likely to fall in the next 6 months.”

It turns out, we can both be right.

Xero shares could fall in the next 6 months, and yet it could be a great 5-year investment.

That’s investing.

For the record, I own Xero shares and it’s still a Buy inside Rask Invest. But please keep in mind, I have a 5-to-10 year view.

We recommended Xero shares to Rask Invest members way back in August 2018, at a cool price of $44.73 per share.

It’s now $149.68 – meaning, our members are up 234%.

Back to school

In early 2020, during the COVID-induced market crash, Xero shares fell ~30%.

Ouch!

Right?

While you could have sold Xero shares before the pandemic wipeout, and you would have looked smart (for about two months), the reality is selling Xero shares then would have been a huge mistake.

The reason I recommended Xero (and still own it) needs some explaining…

But quickly, before you read on, please keep some of my ‘golden investing rules’ in the back of your mind…

First, I only ever buy shares that I believe I will still be able to hold 5 years from today.

That means I need my companies to be incredibly resilient and, therefore, capable of growth.

Second…

In the modern investing era — where ETFs are going to make up 50% or more of smart investors’ portfolios — if you are buying individual companies for growth, there’s no point wasting your time trying to buy “out of favour stocks”.

If you’re right about a beaten-up company’s valuation, which is hard, most “cheap stocks” aren’t market leaders that are capable of growing 5x or 10x, because they’re not run by visionary CEOs, nor are they truly resilient.

And even if you are right about your valuation, chances are, you’ll want to sell the stock once it hits your valuation — that means, you’ll incur capital gains tax for the privilege of selling.

So instead of trying to time the market, why not simply build a core portfolio from ETFs and, if you want to, add shares in only the very best individual companies you can find, with a view to never selling.

For example, you could have 5 ETFs in your Core and however many individual high conviction share ideas around the outside.

Your Plan A is finding great companies, but your backstop, or Plan B, is a diversified, low-cost, dividend-paying, probably tax-effective portfolio made up of ETFs.

If only there was a place you could find recommendations on all of them…

Ok, enough digressions.

So, why did I recommend Xero shares? What did I see that others didn’t?

Inflection points.

“Inflection point” is a phrase bandied around by pro investors and fund managers. Yet I have serious doubts many of them have even experienced what it means (because fund managers own a position for, on average, just 7.4 months!).

An inflection point occurs when the financial performance of a business massively improves much faster than you can imagine.

Specifically, this is when the operating profit (EBIT, EBITDA, etc.) can rise much faster than the revenue/sales.

Good company CEOs know how powerful an inflection point can be.

Good analysts know what it means.

But only good long-term investors know how to find — and capture — the power of a company going through its inflection point.

Here’s what I wrote to Rask Invest members in August 2018, when I recommended they buy Xero shares:

Basically, investors, analysts and even accountants (who loved Xero software, and recommended it to clients) would say “Xero isn’t profitable, therefore it’s not a good business.”

However, consider, as I wrote above, if Xero cut its variable costs (e.g. marketing) in half. Completely in half.

Imagine that.

What would happen?

The result would be, Xero is HUGELY profitable!

So why doesn’t it do that? Why doesn’t it cut some costs?

The reason is every $1 spent on marketing returns multiples in the years ahead.

To me, this hidden acceleration in financial performance (i.e. “operating leverage”) was clear as day.

Remember, “fixed” costs are the things a company can’t avoid.

For a company like Woolworths (ASX: WOW) that might include inventory, distribution and warehousing.

For Xero, fixed costs include cloud hosting, support for subscribers and data feeds for its automations.

Basically, Xero has bugger-all fixed costs.

By contrast, variable costs include things that ‘can be managed’. Things such as (some) marketing, R&D and admin costs.

Put another way, you could still run Xero’s business with 50% less marketing.

But the key insight is that marketing spend will fuel aggressive revenue/sales growth. And as you grow, the marketing cost (as a per cent of revenue) will fall. Meaning higher margins.

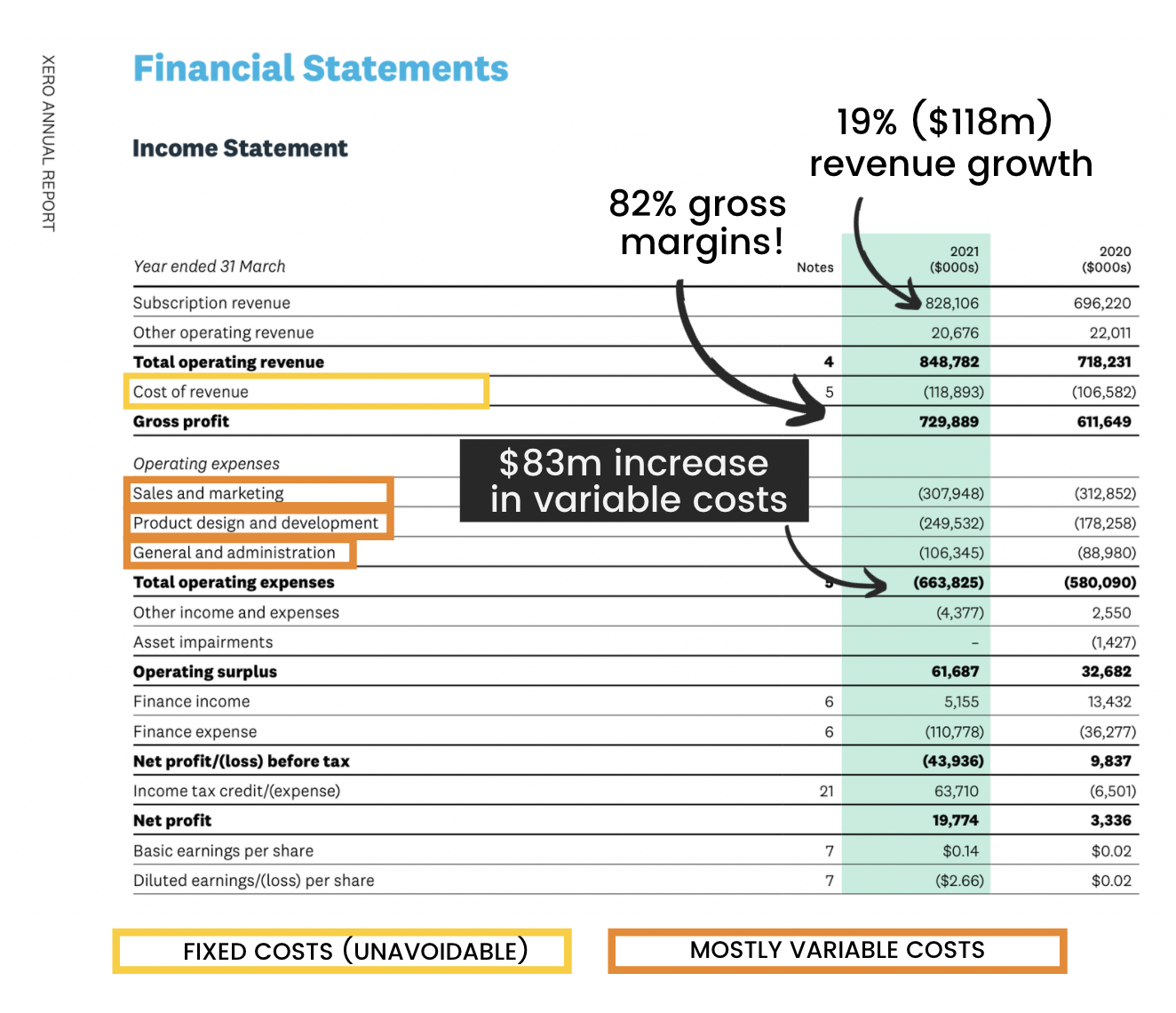

The image shows Xero is already at an inflection point.

As you can see above, Xero’s “operating surplus” (aka Operating Profit) is only just kicking into overdrive. And yet it’s still spending heavily for growth ($307 million on marketing alone).

Operating leverage

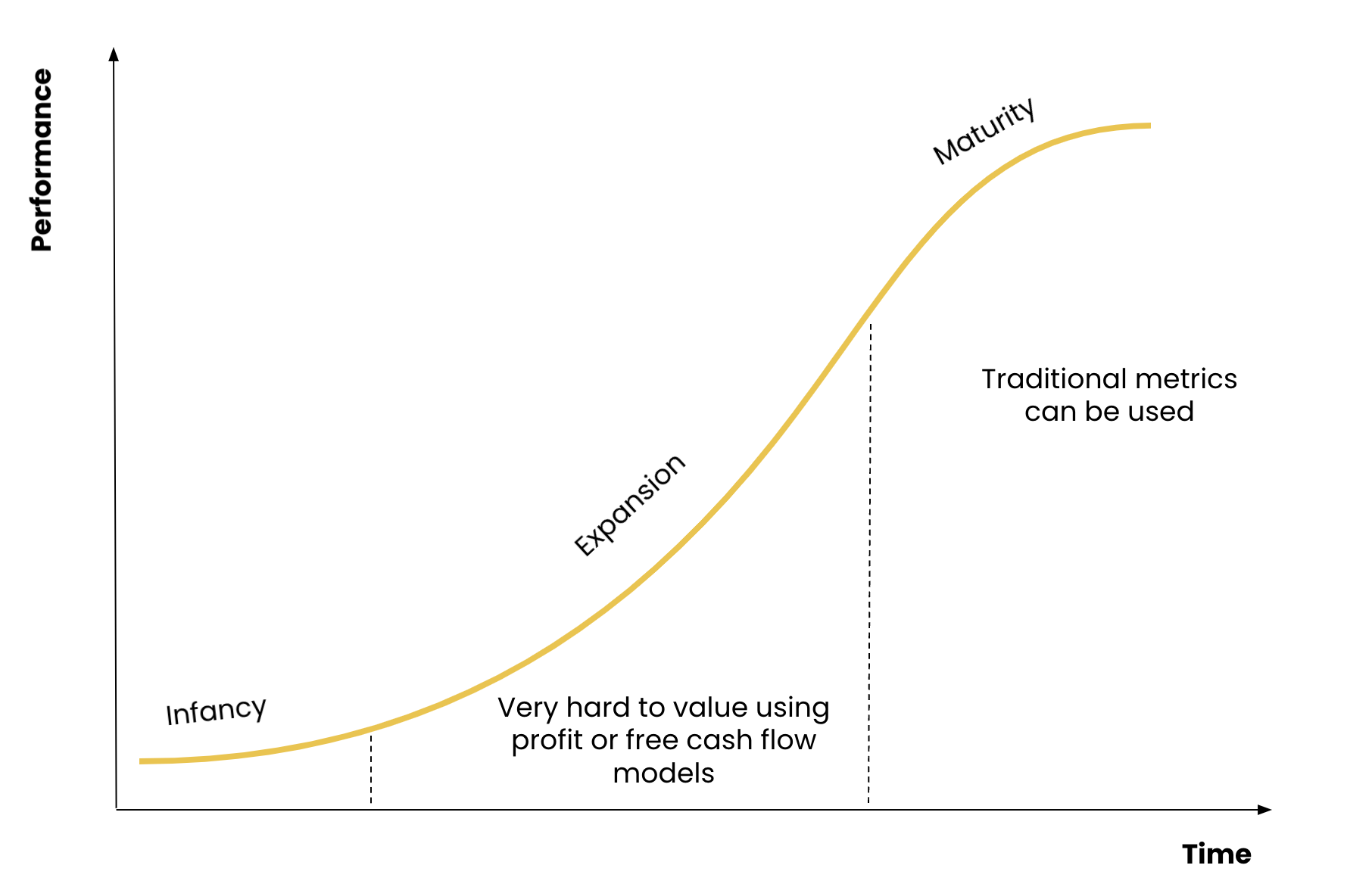

The key point is this: you want to own a company’s shares right before it hits an inflection point, and during its acceleration.

Some investors will refer to this type of growth as an “S curve” because the growth in performance looks a little bit like the letter ‘s’.

(Note: the S-curve is also used to describe the adoption of new technologies, like mobile phones, the internet, blockchain, etc.).

How can I find inflection points?

I don’t have a perfect formula to identify companies in this phase of growth. No one does.

I think the key ‘tell’ for Xero was how much in love its users were with the software. They didn’t even mention the subscription cost! Small businesses, accountants, medium businesses — everyone loved it! The network effect was massive.

Takeaway #1: always speak with customers.

Another key insight, I believe, was the number of third-party app developers who were building their apps and services to integrate with Xero. This was a strong sign that developers — those who are at the pointy end of new technologies — were saying ‘we need to use this rapidly growing accounting platform because that’s the future’.

Takeaway #2: monitor the forums of developers for activity.

Another insight is that these companies (and their share prices) move fast. Winners often keep winning, and investors know this. So you often find yourself “overpaying” for one of these companies in the early months or years. Xero took around 4 years to return to the share price high following its IPO on the ASX. Imagine being at a loss for 4 years!

Takeaway #3: focus on the business performance, not share price.

My third point is this: you won’t get them all right. In order to find these rapidly-growth companies in their early days, you will make mistakes. You will make big misses shooting for the stars.

Takeaway #4: play it smart and never “invest it all” in one idea.

In my view, 95% of the research work to find great companies is NOT done in a spreadsheet. It’s qualitative.

Even though I have an intrinsic valuation for Xero shares, based on free cash flows, it’s definitely not perfect. And it can’t be.

Companies experiencing such rapid growth are not easy to value. That’s why the most important research work you will do is not buried in a spreadsheet. While I think that’s important, the most important work you will do is learning about the company, speaking with customers, learning about competitors — and figuring out how big the market opportunity really is.

If the addressable market is BIG and the company is leading the pack, it’s a key insight that your company could be capable of significant long-term growth (just don’t be fooled by promotional management — always do your own industry work).

Takeaway #5: In other words, focus almost all of your attention on the value the company is creating. Then, and only then, ask yourself ‘how much value is the company capturing for itself?’.

If you made it this far through my weekly Investor Club email, well done. And thank you.

If you want to find more of my share ideas, join Rask Invest. Otherwise, I’ll see you next week.

Cheers to optimistic, long-term investing!

P.S. This newsletter came from my weekly Rask Investor Club market report, where I help you dissect ASX and global investments, make money, learn & invest better. To join our mailing list and get these insights delivered straight into your inbox, click here.