The Coles Group Ltd (ASX: COL) share price is moving into the green today after the company provided a first-quarter trading update.

Currently, the Coles share price is up 0.52% to $17.43.

Supermarket, liquor rises due to pandemic restrictions

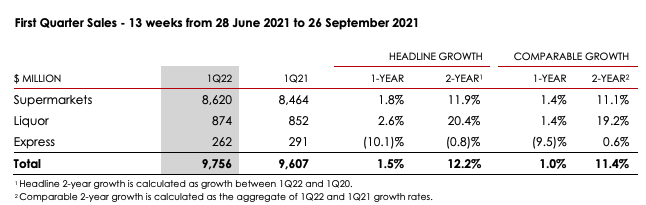

Key highlights for the first quarter ending 30 September include:

- Total group sales of $9.75 billion, up 1.0% year-on-year (YoY)

- Supermarket revenue of $8.62 billion, up 1.4% YoY

- Liquor revenue of $874 million, up 1.4% YoY

- Express revenue of $262 million, down 9.5% YoY

Supermarket revenue was buoyed by lockdowns across New South Wales, Canberra and Victoria as customers were forced to cook at home.

Subsequently, there was a shift away from shopping centres towards local outlets. Over a two-year horizon, supermarket sales are up 11.1%.

More grocery shopping moved online, with e-commerce sales up 48% YoY and 132% compared to FY19. Online penetration now accounts for 9% of sales.

Coles brand sales grew 6% to $2.8 billion. In-house products are generally higher margin, as Coles cuts out the middle-man producer.

Liquor sales also remained elevated, due to venue closures. Compared to FY19, Liquor sales are up 20.4%.

Gains in supermarkets and liquor were offset by Express, which was impacted by reduced road traffic. Over a two-year period, express sales have declined 0.8%.

Pandemic wreaks havoc on operations

Similar to Woolworths Group Ltd (ASX: WOW), Coles suffered from significant pandemic disruption in the first quarter.

Over 20,000 team members were forced to isolate themselves. Subsequently, the business incurred $75 million in additional COVID-19 costs.

Supply chain pressure rocketed, due to lower productivity levels as a result of shift bubbles at distribution centres.

Gearing up for a big holiday season

With the end of restrictions on the horizon and record-high consumer savings, Coles is looking to capitalise on a big holiday season.

In the first four weeks of the second quarter, Supermarket revenue remains steady while Express continues to be impacted.

Pandemic costs are expected to peak in October and reduce over the following months.

As a result of pandemic disruptions, planned store upgrades and refurbishments have been pushed back. More details will be provided in the half-year report in February.

My take

Coles had a solid quarter but was outpaced by major competitor Woolworths, which achieved a 7.8% jump in sales.

The reduction in restrictions will be a positive for the company as traffic increases, pandemic costs fall and migration eventually picks up.

However, this will be somewhat offset by reductions in all-time high supermarket shopping as customers dine out.

Looking for new share ideas? Check out two ASX shares I’d buy and hold for the next decade.