It’s been another busy week of ASX shares reporting. Here’s your recap of all the big movements.

Volatility is the price of entry

If there’s one word to recap this week of ASX shares reporting season it’s volatile.

It’s rare to see a single ASX share (of sufficient size) move up or down more than 10%.

This week it happened every day:

Monday: Tyro Payments Ltd (ASX: TYR) tumbled 26% as costs outpaced sales.

Tuesday: Nanosonics Ltd (ASX: NAN) fell 16% as revenue was downgraded

for FY22.

Wednesday: Domino’s Pizza Enterprises Ltd (ASX: DMP) plummeted 17% on slower than expected growth

.

Thursday: Appen Ltd (ASX: APX) sunk 28% after it missed its own guidance.

Friday: Block Inc (ASX: SQ2) rocketed 36% after smashing expectations.

Companies that outperformed were rewarded. But businesses that missed the mark were punished.

Volatility is the price of admission in share markets.

This week hasn’t been for the faint-hearted.

Pandemic hits the big guys

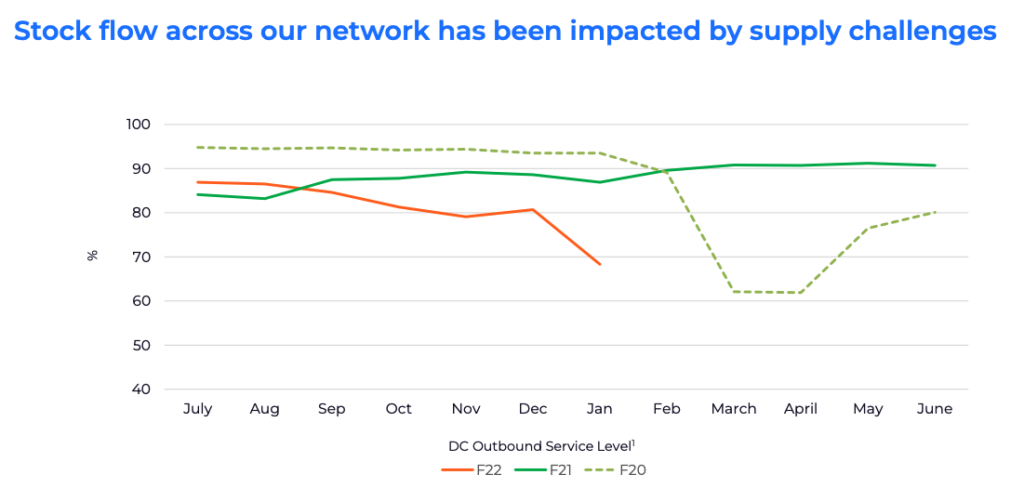

The two big supermarket ASX shares Woolworths Group Ltd (ASX: WOW) and Coles Group Ltd (ASX: COL) announced strong half-year results during the week.

But the overarching theme from both CEOs was the outsized impact of the pandemic.

Supply chains have been crunched.

Staff absenteeism spiked over December and January as Omicron took hold.

And inflation is coming through in the form of packaging and costs of goods.

All this hit the bottom line for supermarkets, which already have razor-thin margins and rely on volume to produce earnings.

Turnarounds seldom turn

Warren Buffett famously said, “turnarounds seldom turn”.

Turnarounds are businesses that have gone through a period of difficulty and are hoping to turn their misfortunes around.

The issue with turnarounds is that more often than not, it results in tears for investors.

Former market darling A2 Milk Company Ltd (ASX: A2M) saw its half-year earnings fall by 45%.

Births in the key Chinese infant milk formula retraced 18%, and the business is losing share to local competitors.

Subsequently, the A2 Milk share price is down 73% from its highs in 2021, with few positives going forward.

Embattled software company Nuix Ltd (ASX: NXL) is another turnaround that hasn’t turned.

It’s made every mistake in the book – CEO and CFO departing, disclosures issues, whistleblower complaints, dwindling sales and missing its own forecasts.

New CEO Jonathan Rubinsztein has quite the task ahead of him.

No money, no love

It was a horror week for ASX shares that make no money.

That might sound like an oxymoron, but small-cap companies who don’t make a profit saw their share prices particularly smacked this week.

Zip Co Ltd (ASX: Z1P) led the declines after it announced a cash EBITDA loss of $108 million for the half.

That wasn’t great. But even more troubling was that the business provided the trading update four days ahead of its scheduled reporting date – without an explanation.

Later that week it delayed the original result date to next week.

With the current cash burn, it’s possible Zip is busy drumming up interest in a capital raising over the weekend to keep the business going.

Nonetheless, companies making no money are getting no love from the market currently.