It’s been a crazy few months, hasn’t it? Rates, Elections, inflation…

You may remember that a few months ago I prepared a few short instructional videos on the impacts of inflation and rising interest rates.

Including the video below on the types of companies to avoid.

Moats and where to find them

There’s a lot to be worried about. Inflation, global food shortages, rising interest rates and so on.

In the short run, from 12 months to 3 years, you can expect the stock market to be very volatile. I have no idea where Australia’s S&P/ASX 200 (ASX: XJO) or the USA’s S&P 500 will be trading during this time.

However, over the long run (3, 5 or 10+ years) I am very confident that the companies that will win are those with strong and defensible business models.

In simple terms, “wonderful businesses”.

The types of businesses that have commanding market positions, leading products or services, great management teams and rock-solid balance sheets.

Think of the Apples, Googles, Amazons or Microsofts of today.

When times got really tough during 2008/2009, these companies didn’t slow down — they accelerated.

Ultimately, these are “wide moat” companies. Companies with competitive advantages and dominating market share.

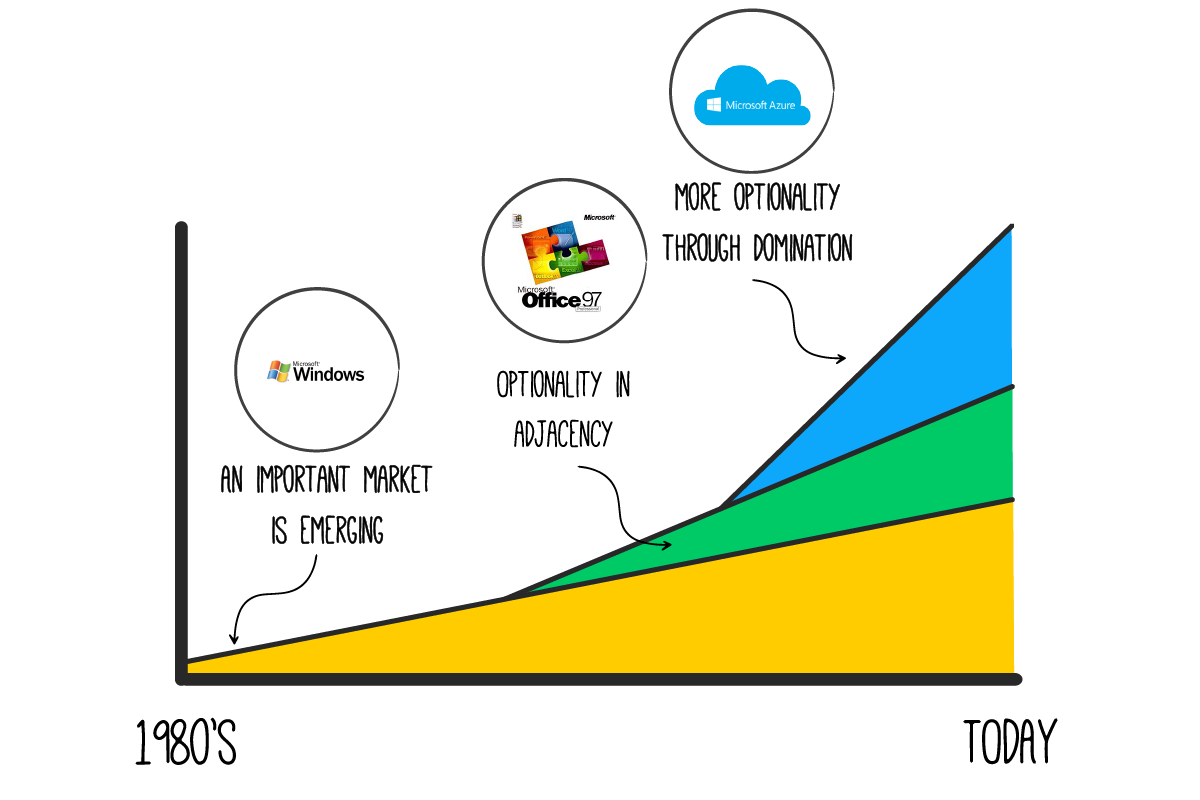

They innovate, grow and accelerate when others fall by the wayside. Microsoft, for example, has survived the early 90s recession, dot-com bust, GFC and Covid Crash.

All the while it has accelerated into new markets and adjacencies.

In one of the most recent Australian Investors Podcast episodes, I spoke for ~27 minutes and covered everything you need to know about finding, researching and owning companies with wide moats.

However, I’ll leave you now with one more thing.

When you’re investing in strong companies it makes sense to fish where those companies are found.

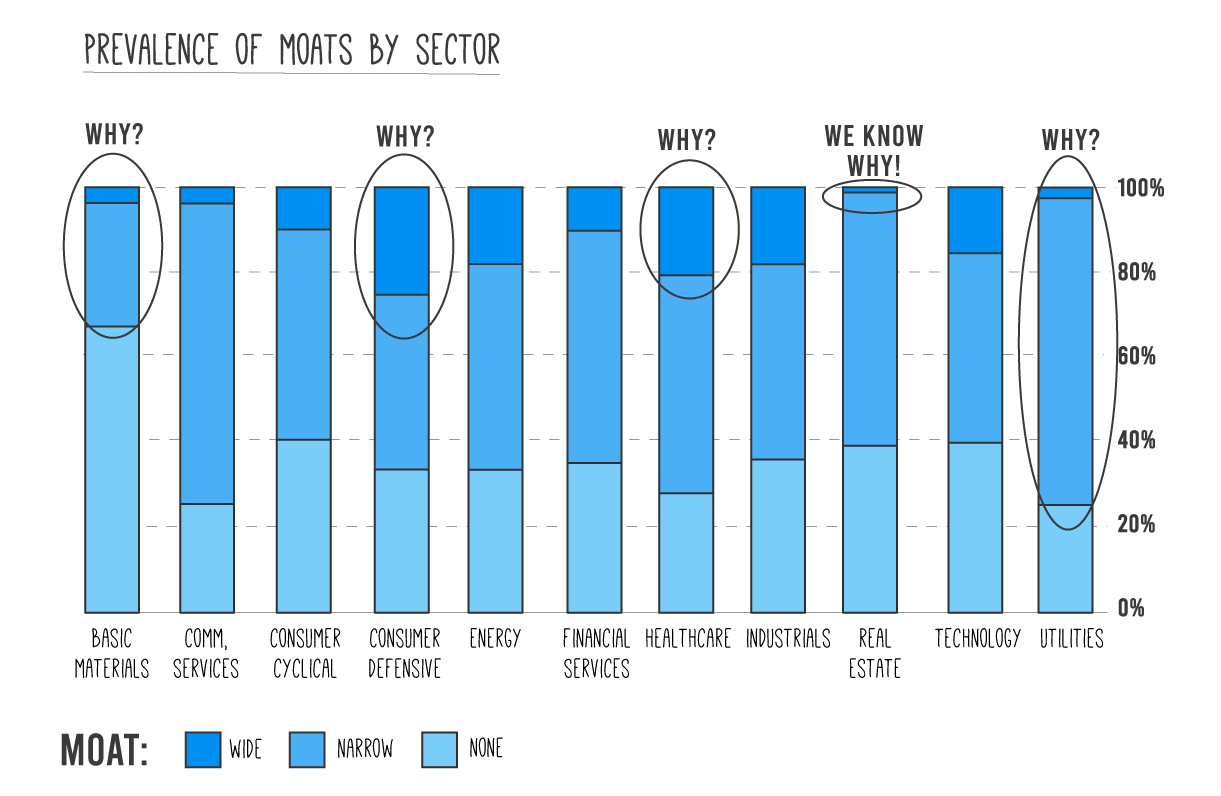

The following chart from Morningstar shows you which industries (materials, communication services, etc.) house the companies with the widest moats (strongest advantages).

As you can see, consumer staples – think Woolworths Group Ltd (ASX: WOW), Coles Group Ltd (ASX: COL), Costco (NASDAQ: COST), etc. – and healthcare – think CSL Limited (ASX: CSL), Cochlear Limited (ASX: COH), Sonic Healthcare Limited (ASX: SHL), etc. – could be the most fruitful hunting grounds.

So why not start there?

Cheers to optimistic, long-term investing!

P.S. This newsletter came from my weekly Rask Investor Club market report, where I help you dissect ASX and global investments, make money, learn & invest better. To join our mailing list and get these insights delivered straight into your inbox, click here.