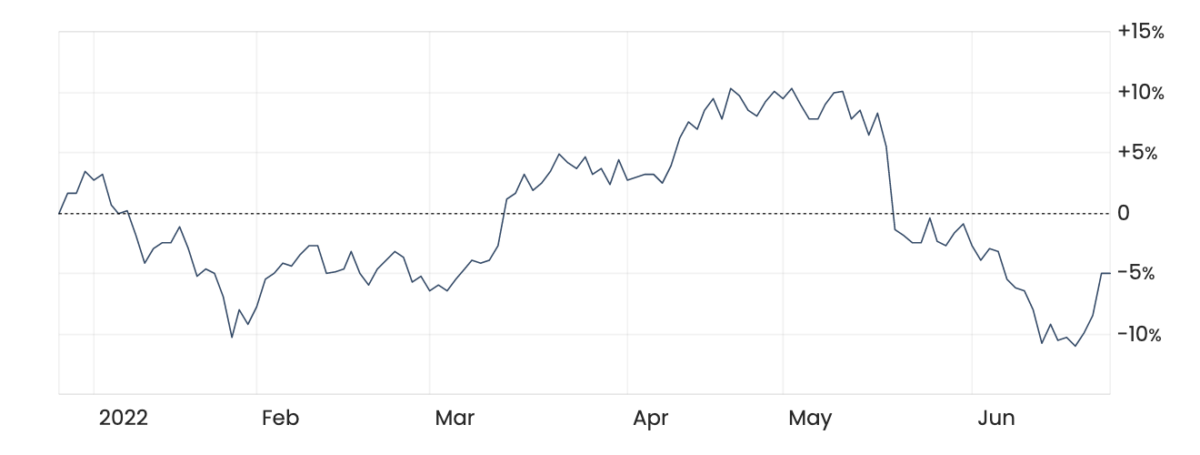

The Metcash Limited (ASX: MTS) share price bounced a hefty 3% today, taking the Woolworths Group Ltd (ASX: WOW) share price and Coles Group Ltd (ASX: COL) share price along for the ride. The MTS share price is mostly flat over the past six months, according to Rask Media.

MTS share price return, six months

Why is the MTS share price jumping?

As my colleague Jaz Harrison wrote earlier today, the Metcash share price is jumping higher following the release of its 2022 financial results. Revenue was up 5.9% to $15.2 billion and full-year dividends of 21.5 cents per share, fully franked, were declared.

Metcash’s dividends per share were up 23% thanks to a robust increase in profit/earnings per share.

Are Metcash shares a buy?

So far in 2022, Metcash shares have kept pace with Woolworths (both are down about 5%) while Coles Group (COL) shares are marginally higher. It’s been a good period for Metcash, especially in its Mitre10 and Home Timber & Hardware divisions, with construction levels pushing product prices higher and helping drive group earnings.

According to data pulled from Tikr, shown above, Metcash shares continue to trade at elevated levels against its historical average (I used EV/EBIT as a proxy for valuation). However, in my opinion, a better way to get a sense of the Metcash share price valuation is to look at its dividend yield.

Metcash’s dividend yield is around 4.8%, which is mostly in line with its average over the past 7 years, and above the dividend yield of Woolworths and Coles shares. This is probably explained by the relative riskiness of Metcash shares versus those of the two behemoth supermarkets.

Ultimately, if Metcash can maintain or grow its dividends to shareholders, it could be one to add to a dividend-focused watchlist or portfolio.

What I’d buy before Metcash shares

If I was focused on dividend income from my portfolio, there are alternatives I would buy first. As I noted in a recent episode of The Australian Investors Podcast, I would buy one of my top 5 Australian shares ETFs for dividend income.

For example, I would buy units in the Vanguard Australian Shares ETF (ASX: VAS) or iShares S&P/ASX 200 ETF (ASX: STW) ETF before Metcash shares.

The reason is that instead of buying one share (Metcash) for its income potential, if you buy an ETFs like STW or VAS you get exposure to a ‘basket’ of 200 and 300 (respectively) Australian shares.

You might also consider the Vanguard Australian Shares High Yield ETF (ASX: VHY), an ETF that targets dividend income. Using the VHY ETF could be a benefit to those investors who are seeking to avoid as much capital gains tax (CGT). Then again, one benefit of owning Metcash is the ability to control when you incur CGT. See our video: ‘how are ETFs taxed?‘)

In summary, I think Metcash is a fine Australian business with dividend potential. However, there are many ways to get your dividend income — and I prefer the ultra-low-cost and diversification benefits of ETFs. Don’t forget that Drew Meredith, CFP and myself are halfway through our Passive Income mini-series on The Australian Investors Podcast — subscribe and you’ll get the latest episodes when they are released.