The Dubber Corp Ltd (ASX: DUB) share price was suspended on Monday morning following what is, as far as I can tell, a failure to lodge audited financial accounts for shareholders.

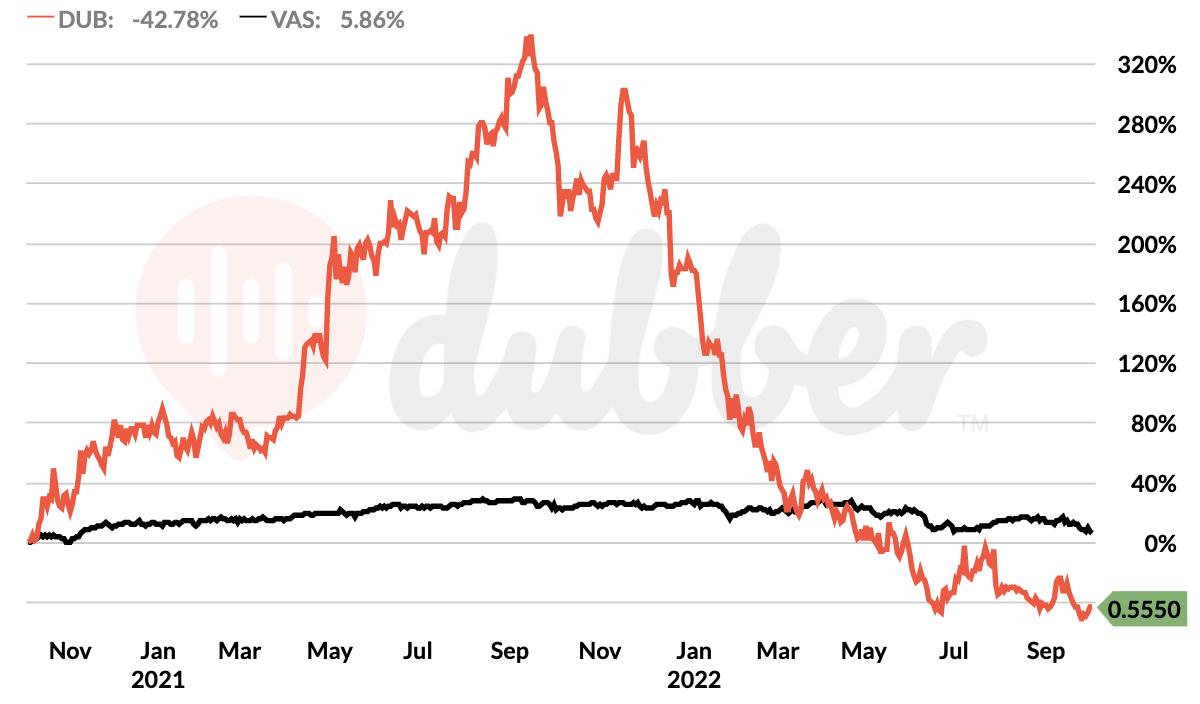

The Dubber share price has been on a downward spiral since last year.

The following share price chart compares Dubber to the Vanguard Australian Shares Index ETF (ASX: VAS), or simply ‘the overall share market’. It gives you a sense of the performance of a company against a low-cost ETF.

Dubber share price on the nose

Who is Dubber?

Dubber describes itself as, “the world’s leading provider of cloud-based call recording and voice AI”. Basically, it records calls made to or from big corporates and attempts to run analysis on things like keywords, to gauge the sentiment of calls (e.g. was the customer service call negative or positive in tone?). It has a speciality in compliance (e.g. for calls made to banks or insurers).

Dubber’s big idea is that it hopes to take something that was traditionally done as an on-premise system (e.g. by big computers in the basement) to make it cloud-based (where it can sell subscriptions for usage). There are other companies that do this, but Dubber claims to be the leader and the one who specialises in partnering with carriers (e.g. Optus) (note: to offer what it does today, Dubber has had to make numerous acquisitions).

Why is Dubber suspended?

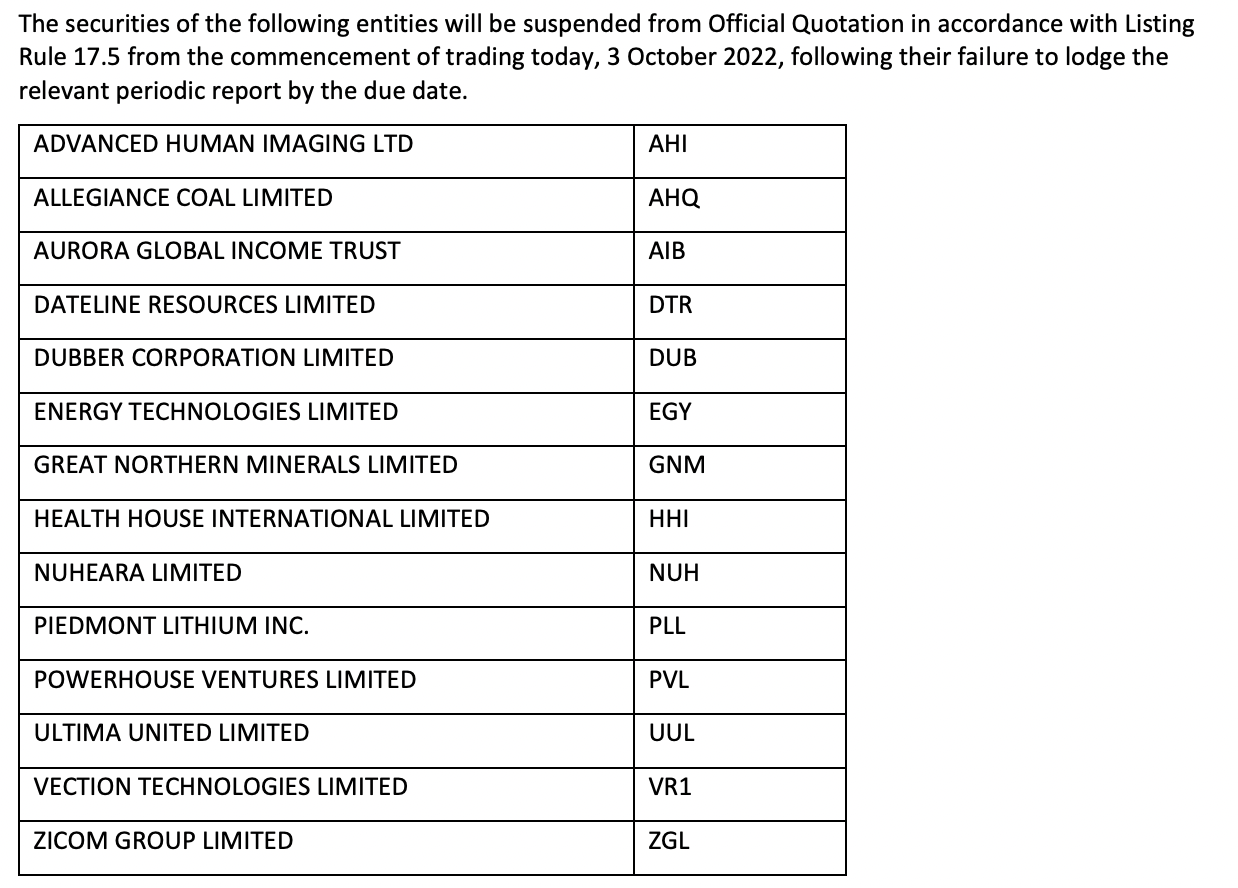

Dubber isn’t the only ASX company to be suspended by the ASX this week.

A bunch of mostly smaller, speculative mining companies were also suspended for failing to lodge their periodic report – in other words, financial accounts that have been audited.

It’s worth noting that the only other well-known company on the suspended list is Piedmont Lithium Inc (ASX: PLL), but this was promptly reinstated to active trading on the ASX once they realised it didn’t lodge its accounts because it changed reporting calendar.

In other words, Dubber is the only company that is reasonably well known which has failed to lodge audited accounts.

What’s going wrong with Dubber?

I want you to know something: this is not the first time Dubber has failed to lodge its audited accounts by the deadline.

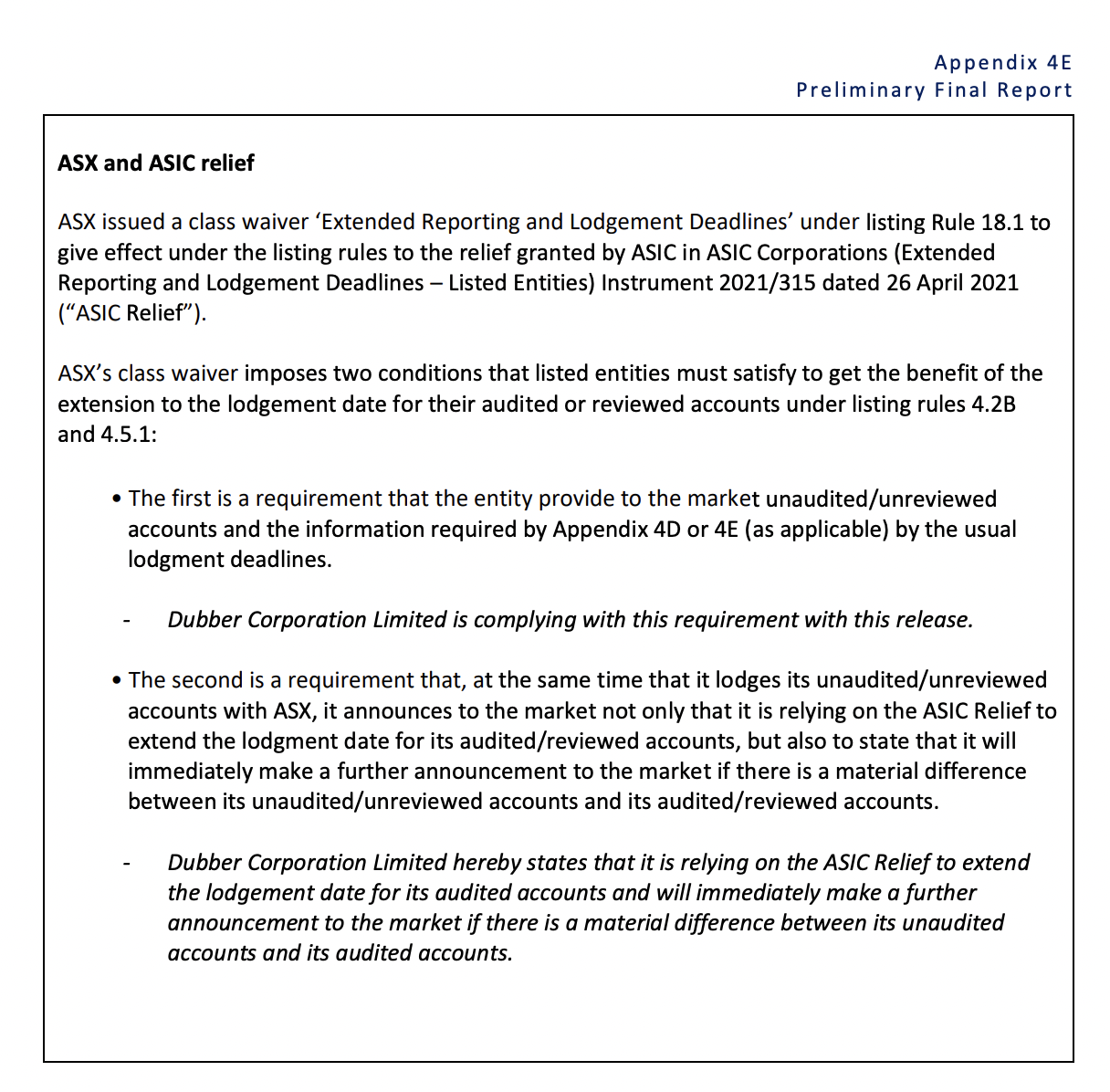

Dubber FY21 report (filed 31 August 2021), highlighting ‘relief’

Last year (August 31, 2021) Dubber couldn’t lodge its audited accounts on time, as “the Financial Report is in the process of being audited”. So it was able to get “relief” to delay the release of the audited financials.

From what I could tell, Dubber subsequently reported its results to shareholders on November 1st 2021. That means, Dubber took from August 31st to November 1st (two months) to get the company’s audited annual report to shareholders. Yet the accounts were already “in the process of being audited” when it made the announcement?

Two months sounds like a long time, especially considering the business isn’t that complex, or big. For context, Woolworths Ltd (ASX: WOW) released a 183-page audited report on August 25th this year. It took Nanosonics Ltd (ASX: NAN) until only August 23rd to do the same. These two companies use a Big Four auditor.

But is there something wrong with Dubber?

In short, I think there could be something wrong. Or at least, shareholders deserve an explanation.

I believe something is not quite right at Dubber. Maybe it’s just a hunch and I’m wrong. Or maybe it’s as simple as a company that is trying to give the perception that it is a high-quality software company when it’s struggling to scale effectively.

A failure to lodge audited accounts is a red flag for me. And a meaningful one.

Last year, we ‘might’ have excused Dubber for its accounting delays because of the many acquisitions it has made (which make audits more complex), or because of delays due to Covid (making it harder for auditors to travel).

I don’t want to get into all of the various concerns that ‘could be’ here — our Rask Invest members know all of the reasons why I issued a sell alert on the company’s shares in March 2022.

Oh dear $DUB https://t.co/UDfbUJbZU2 pic.twitter.com/0zwho9ikds

— Owen Rask 🇦🇺 (@OwenRask) August 1, 2022

If you want me to go into depth about all of the reasons why it’s concerning to me, you can ask me a question on The Australian Investors Podcast for an upcoming Q&A episode.

(Last week I was asked about Dubber on the show and just said it’s “not good”.)

Summary

As I’ve followed along with Dubber, it has sadly moved from weakness to weakness.

I want Dubber to be a success.

That’s why I recommended shares at one point (note: I don’t have a position for, or against, it nowadays).

However, one thing I don’t like to see from ASX-listed companies is, in my opinion, a failure to promptly inform loyal and trusting shareholders of the performance of a business.

After years of acquisitions, buzzwords, high levels of spending, and poor incentive structures (all in my opinion), I hope shareholders get the clarity they deserve.

If you are a shareholder, you might consider writing to management and asking them:

- Why did the company take longer than it should to get audited accounts?

- Excluding acquisitions, what is the company’s organic growth rate over the past 3 years?

- What is the company’s average revenue per user?

- Why does the company offer zero-exercise price options (ZEPOs) instead of asking employees to pay for their options?

- What is there to stop a suspension from happening again?

Dubber shareholders own the company, so I think they deserve answers to these key questions and would benefit from even a short update via the ASX.