We consider Metcash Ltd (ASX: MTS) to be an interesting opportunity in the ASX mid and small-cap segment. It is owned by the Contact Australian Ex-50 Fund and BKI Investment Company, writes Will Culbert.

Prefer to listen to Will on The Australian Investors Podcast? Get it here:

The pause in RBA interest rate rises in April 2023 was short-lived. The higher interest rate environment is being felt in segments of the economy. For some, cost-of-living strains are flowing through to the Consumer Discretionary sector. Several stocks are getting caught up in the negativity.

In the mid-cap and small-cap segment of the market, we consider Metcash Limited to be an interesting investment opportunity. It is owned by both BKI Investment Company and the Contact Australian Ex-50 Fund.

This Consumer Staples business is trading at a compelling multiple compared to peers and seems to have been caught up in the selloff in Discretionary names. In this Contact Insights piece, we discuss why we consider MTS to be a Quality Company at a (more than) Reasonable Price.

About Metcash

Metcash Ltd (ASX: MTS) is Australia’s leading wholesale distribution and marketing company. It provides services to an extensive network of independent retail and wholesale customers across the Food, Liquor and Hardware sectors.

Metcash’s core competency is Wholesale & Logistics. The company serves numerous well-known brands across its sectors (as depicted in the following graphic):

MTS has breadth. It supplies over 1,600 independently owned supermarkets (IGA/Foodland) and a wholesale offering to more than 90,000 customers including petrol forecourt retail and convenience businesses. The Liquor business is the largest supplier to independently owned liquor retailers (c.2,700 stores and c.12,000 liquor customers). Hardware operates under the Mitre 10, Home Timber and Hardware and Total Tools Holdings banners and supplies over 1,500 stores catering to both Trade and DIY customers.

MTS was a “Covid winner” as people experienced the benefit of shopping locally for convenience. Importantly, MTS gained customer loyalty during the pandemic as its independent grocers invested in service and range and competed on price. In one Contact Insights piece, we dispelled the myth that IGA was at a huge price disadvantage to the major supermarkets. While we concede that convenience warrants a premium, we were surprised to learn that on a typical basket of goods, the premium was less than 5%. The interim FY23 result was telling, whereby the MTS CEO noted:

“. . .increased preference for local neighbourhood shopping continues …shoppers recognising and enjoying the increased competitiveness, differentiated offer and relevance of our network… many shoppers have now changed their shopping habits to include local grocery, liquor and hardware stores.”

The other important development has been the continued investment into Hardware. MTS acquired Mitre 10 in 2012, Home Hardware in 2016 and 70% of Total Tools in 2020, increasing to 85% in 2021). It now has a network of 736 stores. The Total Tools acquisition further strengthens MTS competitive position in a $20 billion market.

While Bunnings dominates the market with 50%, the MTS network is approximately $3.5 billion (c. 17% share) and has been generating organic EBIT growth at >15% per annum. Total Tools currently has 101 existing network stores with a goal of 130 by 2025. The growth will be supported by its major tool distribution partners (e.g. Milwaukee, Makita, DeWalt, Bosch).

While MTS was a COVID beneficiary, it has also delivered growth through an improved customer offering and investment into Hardware M&A.

What if the anticipated fall in consumption is not as bad as feared?

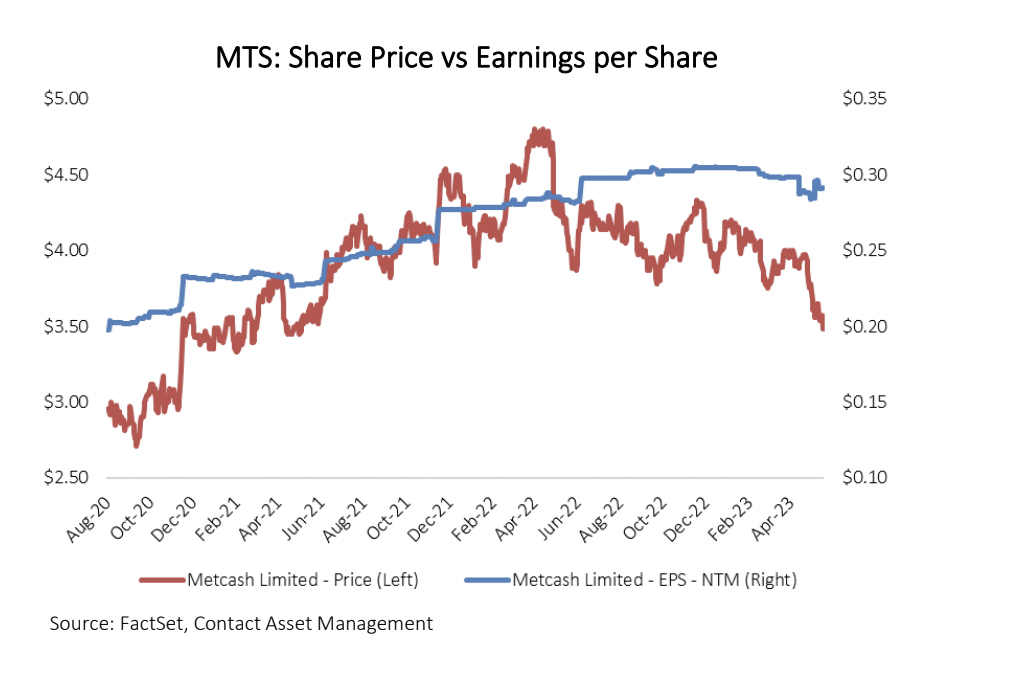

We believe the recent relative weakness in the MTS share price is unjustified. As depicted in the following chart, the share price has derated at an excessive rate when compared to earnings expectations.

A significant fall in consumption is not a foregone conclusion. The rhetoric around the increases in interest rates and the feared mortgage cliff overshadows a critical fact behind the RBA actions. The RBA is lifting rates to attempt to put the brakes on the economy. There is a lot of strength in the underlying economy. Consider the charts on the following page from the most recent RBA chart pack released in early June.

Employment is strong, wage growth is significant and, notwithstanding some pullback in house prices from astronomical levels, household net wealth is still buoyant. Households accumulated a lot of cash during the pandemic. For much of the population, there is still a significant buffer. One only needs to look at the bounce in travel activity and new car sales to see that much of the economy is fine. However, as we’ve noted before, the bear case is always easier to believe.

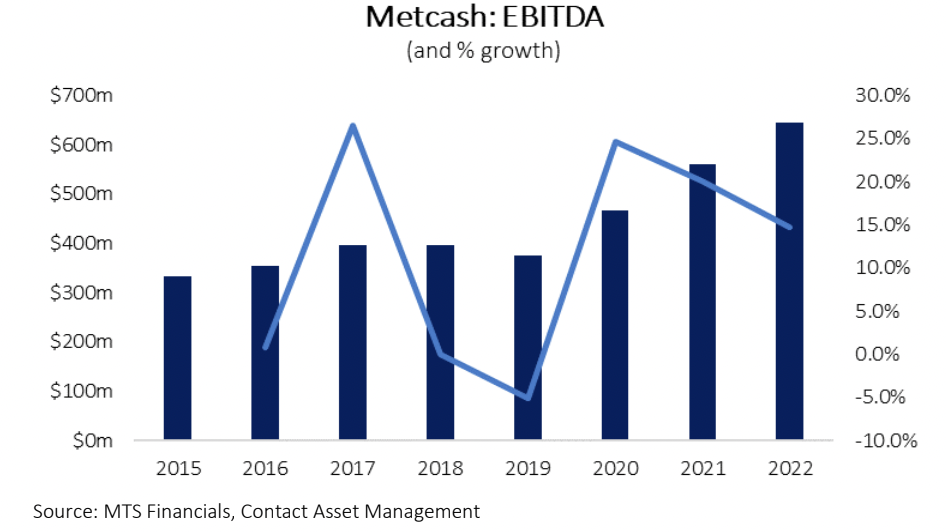

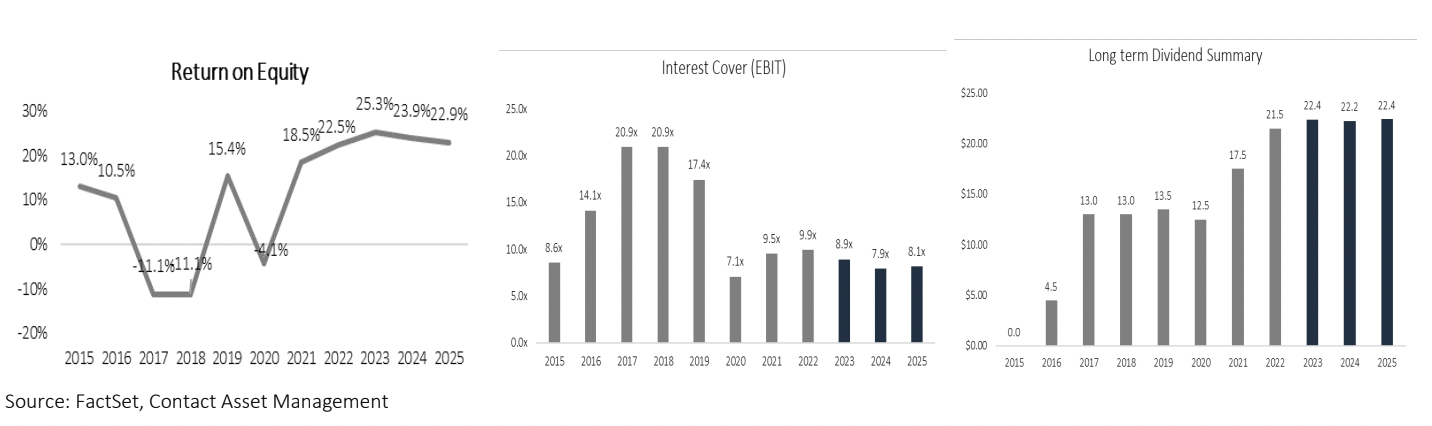

Back onto Metcash, we remain confident in the long-term prospects for the business (and therefore the stock) for several reasons, which we summarise in the following charts:

Key “Quality” factors remain intact – Returns / Balance Sheet and Income.

Our forecasts are not heroic – yet we get a DCF valuation well in excess of the share price.

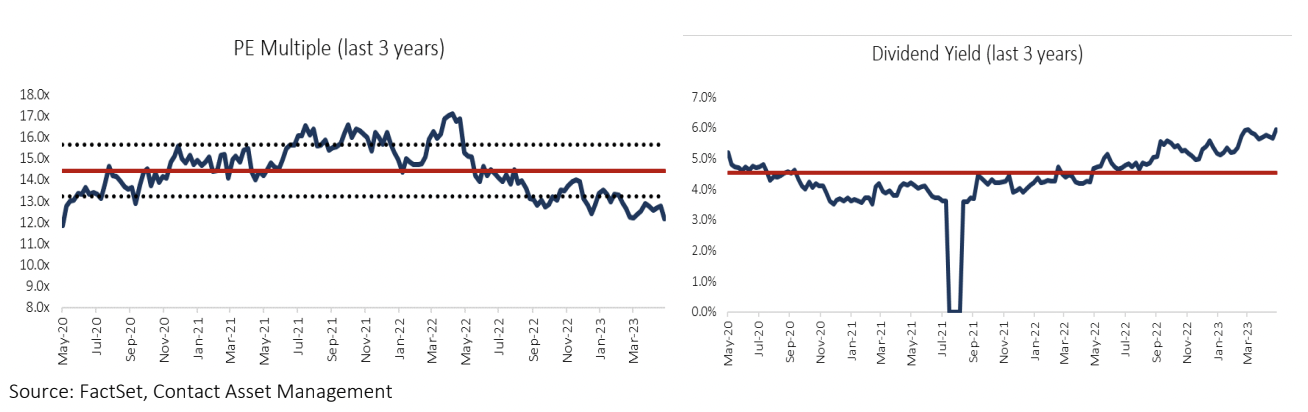

MTS valuation looks compelling.

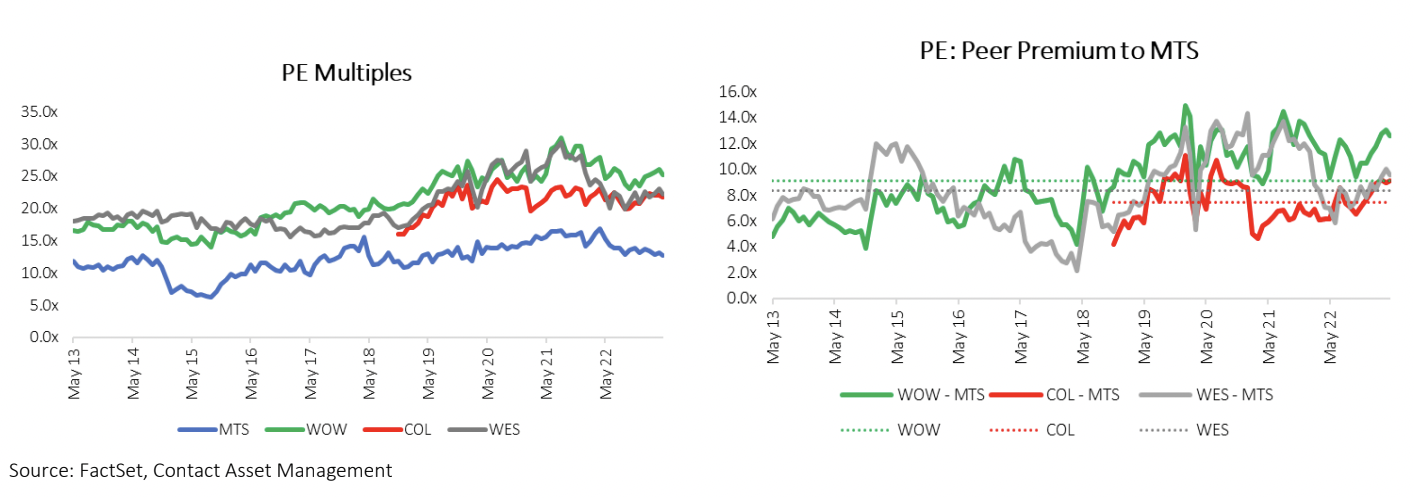

We cannot justify why the P/E discount to peers is as wide as ever.

As noted above, we think the MTS business is in as good a shape as we’ve seen in several years. The growth into Hardware underpins stronger margins, the IGA offering is much improved, and the company continues to execute well. Yet, the P/E discount to Peers is as wide as ever.

The second chart outlines the PE premium (in PE points) between the peer group and Metcash. For example, Woolworths Ltd (ASX: WOW) has traditionally traded at a 9 P/E point premium to MTS (over the last decade). It is currently at a 13 P/E point premium. We remain constructive on the long-term prospects for Coles Group (ASX: COL), WOW, and Wesfarmers Ltd (ASX: WES). However, Metcash does not deserve to trade at such a discount.

Our conclusion

We remain optimistic about the MTS investment case and will seek opportunities to add to our holding in the company. We think the market has been too negative on the near-term prospects. We view MTS as resilient. The various businesses are now leveraging off the superior competitive foundation rebuilt over recent years. The evolution into a solid food, liquor and hardware conglomerate makes comparisons with WOW (24x P/E), COL (21x), and WES (22x) increasingly relevant.