1. Blood banks…

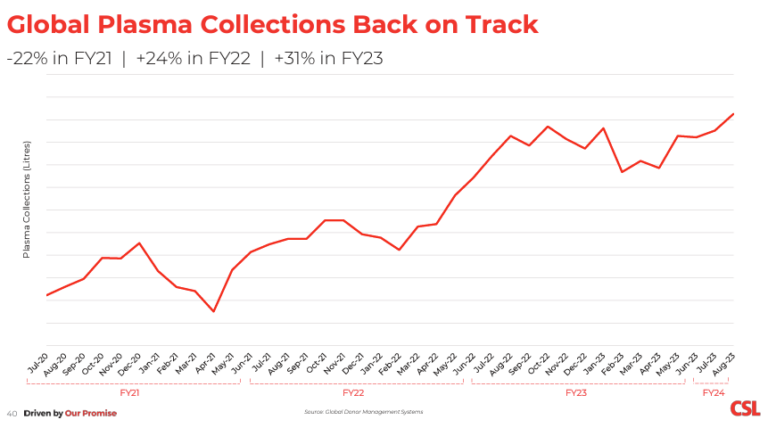

Firetrail High Conviction Fund Holding, CSL Limited (ASX: CSL), held a capital markets day this week. It was pleasing to see that global plasma collections are growing strongly in FY24.

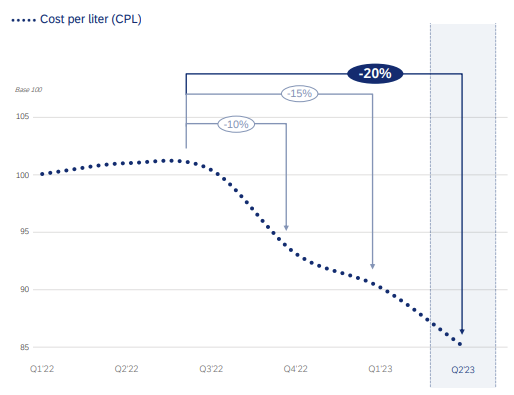

Increased plasma collections help to drive the cost per litre down, as evidenced by data released by competitor Grifols. Behring, CSLs plasma division, makes up 2/3 of CSL group profit. We expect the Behring division can grow in the high-single digits, with the reduced cost per litre leading to stronger margins over the medium term.

CSL is one of our highest conviction positions and is currently trading at a 1-yr forward PE of 24x, a 40% premium to the ASX Industrials. 24x puts it on the same multiple as defensives like Woolworths Group Ltd (ASX: WOW), Wesfarmers Ltd (ASX: WES) and Sonic Healthcare Ltd (ASX: SHL), for ~2-3x the earnings growth!

Source: CSL (October 2023)

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.

Cost per litre of plasma collection

Source: Grifols (October 2023)

Companies mentioned are illustrative only and not a recommendation to buy or sell any particular security.

2. Stability in instability…

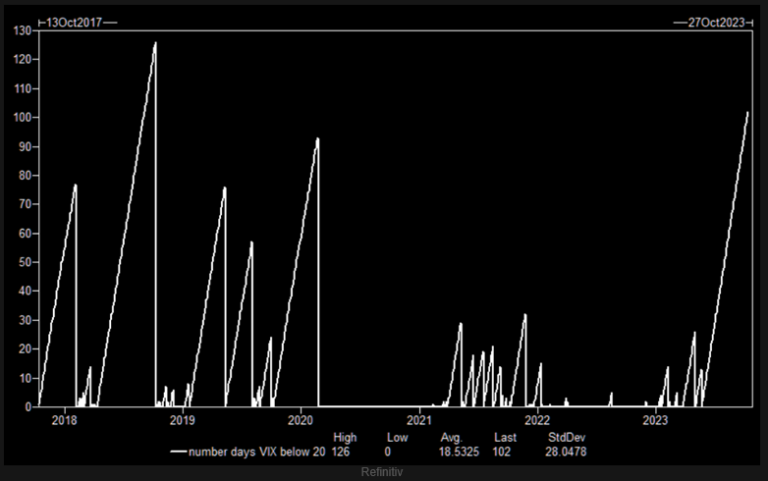

Jamie Dimon, dubbed the most powerful banker in America, warned we are entering “the most dangerous time the world has seen for decades” at the start of the week. But despite all the macroeconomic events happening in the world right now, volatility hasn’t been this benign since pre-Covid.

Up until Thursday, the VIX had been below 20 for >100 sessions straight (since April)!

Number of days VIX <20

Source: Refinitiv, Bloomberg, Evans (October 2023)

3. Drive away deals…

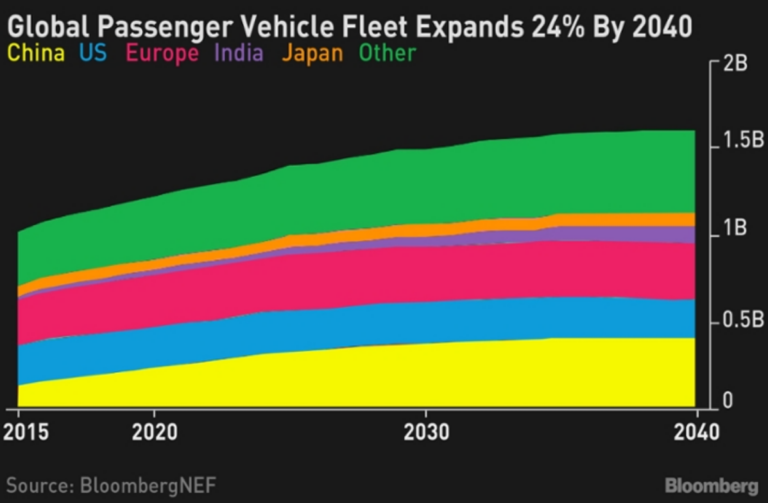

The number of passenger vehicles around the world is forecast to grow by 24% from 2022 to 1.6 billion by 2040, according to BloombergNEF. India is expected to increase its fleet size by close to 150% during the period to 100 million, while EM markets such as Southeast Asia and Brazil could see a 30% expansion. China is expected to account for nearly half of the global growth.

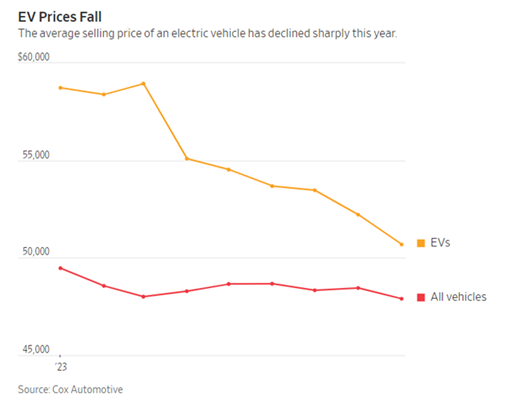

Tesla Inc (NASDAQ: TSLA) had a tough time this week after announcing weaker 3Q results, largely ‘driven’ by their price cutting strategy. The average selling price for EVs has declined 22% over the past year, moving from $65,000 to $50,683, according to Cox Automotive. That makes them only 6% more than the average selling price for all vehicles ($47,899).

Source: BloombergNEF (October 2023)

Source: Cox Automotive (October 2023)