Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.038% to 6854.30.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The market was relatively strong early on, supported by solid overnight gains in the US and most commodity markets, however, the music stopped at 11.30m as local inflation data came in higher than expected.

The ASX200 index fell 65pts from high to low by early in the afternoon, but a small fight back, led by the Materials sector with commodity support, helped to stem the bleeding with the final result of only a small fall on the market.

That came despite just 2 sectors closing higher while Real Estate copped the brunt of the pain.

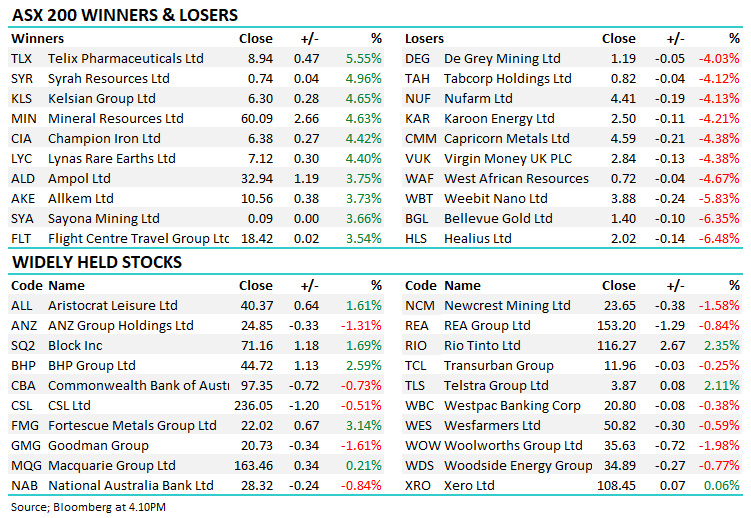

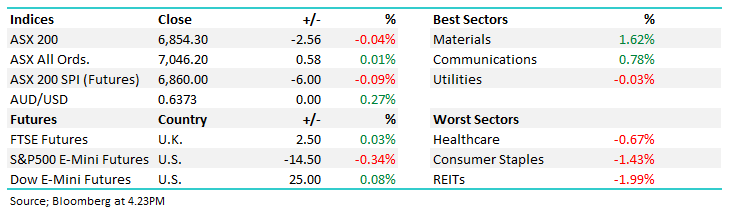

- The ASX 200 finished down -2pts/ -0.04% to 6854

- Materials (+1.62%) was best on ground today, joined by Telcos (+0.78%) as the only other sector in the black.

- Real Estate (-1.99%) was the hardest hit, followed by Consumer Staples (-1.43%) as the only other notable detractor today.

- Inflation Data caused a quick ~0.5% sell-off at 11.30am today. We cover interest rate expectations below.

- Dexus (ASX: DXS) -3.32% quarterly update was a little soft in Office which saw occupancy fall from 95.3% to 94.1% while Industrial was flat at 99.7%. The headlines were more focused on CEO Darren Steinberg’s departure, stepping down after 11 years in 2024.

- Magellan Financial Group Ltd (ASX: MFG) -2.91% CEO David George will also depart, this time more hastily with immediate effect. New Chairman Andrew Formica will take on the dual role while a replacement is found, getting his hands dirty just ~2 months after joining. The company will also spend $7.7m to reduce loan balances on Employee Share Purchase offerings as they try to patch over a clunky incentive plan.

- Corporate Travel Management Ltd (ASX: CTD) +3.22% will kick off a $100m share buyback program next month. The company said EBITDA in Q1 was up 157% and remains on track for FY24 guidance.

- Woolworths Group Ltd (ASX: WOW) -1.98% group sales were up 5.3% to $17.22b, led by a 6.4% jump in Food. They said consumer trends are resilient and in line with the prior quarter while some inflation, particularly fresh food and meat, has started to abate.

- Super Retail Group Ltd (ASX: SUL) +0.25% said Like-for-like group sales for the first 16 weeks were up 2% with strength in Supercheap and BCF offset by Macpac’s weakness. The consumer cliff is still yet to hit.

- Mineral Resources Ltd (ASX: MIN) +4.63% strong quarterly update and a rebound in Materials stocks supported Min Res. Iron ore production was strong, though sales were held back by issues at port. A similar story for the Lithium side as production hit record levels of 45k dry metric tonnes but the port required maintenance which weighed on shipments.

- Iron Ore continued to move higher, adding +3.5% in Asia today

- Gold was little changed today, though gold equities were mostly lower. Ramelius Resources Ltd (ASX: RMS) with a notable fall of -5.63%.

- Indices in the region were strong, the ASX was the black sheep today. China +0.5% was overshadowed by the Hang Seng +1.14% & Nikkei +1.05%

- US Futures are currently trading lower on the back of some softer results after their market closed this morning. S&P 500 (INDEXSP: .INX) futures pointing down -0.3% and Nasdaq futures -0.5%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Inflation Data

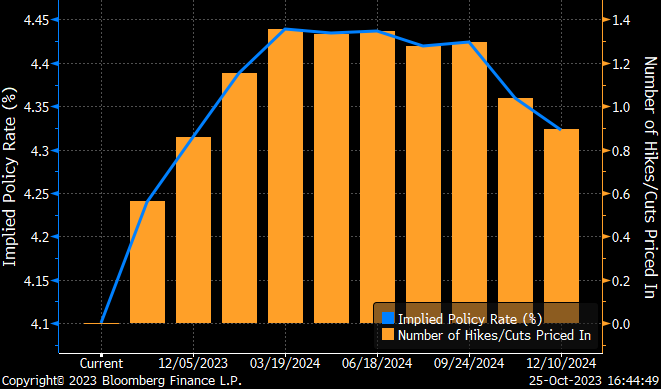

Local CPI data landed at 11.30am causing a sharp selloff in equities as Headline CPI come in at 5.4% YoY vs 5.3% expected and the Trimmed Mean CPI at 1.2% QoQ, slightly higher than the 1.2% and a big jump on the 0.8% 2Q print.

The ASX200 dropped around 0.5% at the time before stabilizing and ending higher through the afternoon to recover some of the damage. Interest rate futures started pricing in a higher chance of a Cup Day hike on November 7, at one point a 70% chance of a hike was being priced in, compared to a one in four chance based on numbers yesterday.

The chart below shows a the market now expects a hike in either the December or February meeting with a ~40% chance of a further hike in March while no cuts are seen on the horizon for 12 months.

Implied RBA cash rates – 25 October

Source: Bloomberg

Broker Moves

- Cooper Energy Ltd. (ASX: COE) Cut to Sector Perform at RBC

- Cettire Ltd (ASX: CTT) Rated New Sector Perform at RBC; PT A$2.75

- Lovisa Holdings Ltd (ASX: LOV) Rated New Sector Perform at RBC; PT A$20

- Accent Group Ltd (ASX: AX1) Rated New Outperform at RBC; PT A$2.20

- Universal Store Holdings Ltd (ASX: UNI) Rated New Underperform at RBC; PT A$3

- Whitehaven Coal Ltd (ASX: WHC) Raised to Accumulate at Ord Minnett; PT A$8.20

- Qoria Ltd (ASX: QOR) Rated New Buy at Ord Minnett; PT 32 Australian cents

- Smartgroup Corporation Ltd (ASX: SIQ) Raised to Buy at Citigroup Inc (NYSE: C); PT A$9.70

- McMillan Shakespeare Ltd (ASX: MMS) Raised to Buy at Citi; PT A$20.70

- Regis Healthcare Ltd (ASX: REG) Raised to Buy at Jefferies; PT A$2.86

Major Movers Today