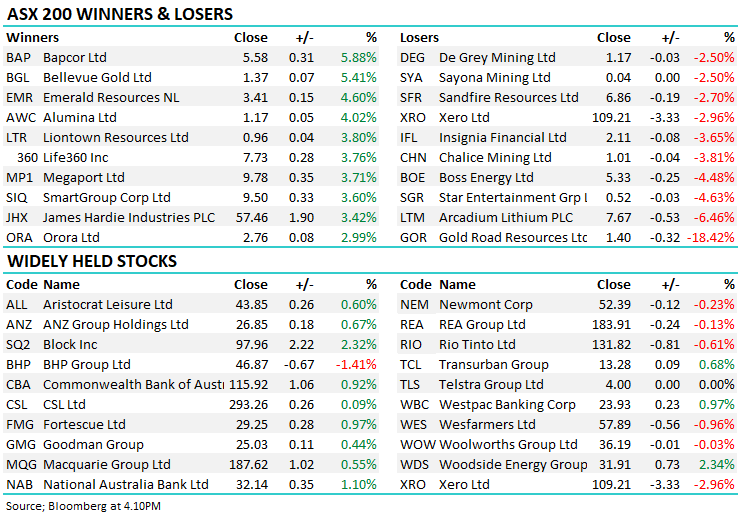

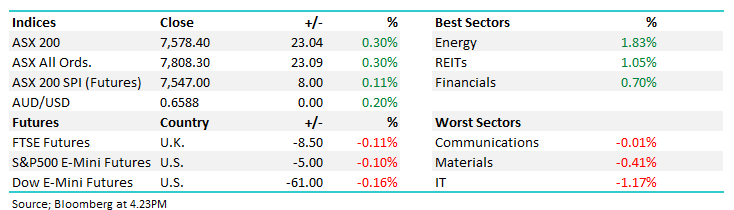

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.30% to 7,578.40.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The market continued to push higher as sector rotation rather than any sign of liquidation/cashing up continued, although, to MM, it does seem the market is slowly losing some momentum after a strong run and ahead of local reporting season– the Market Matters Reporting Calendar linked below.

- The ASX 200 finished up +23pts/ +0.30% to 7578.

- The Energy sector (+1.83%) was strong as were REITs (+1.05%) & Financials (0.70%).

- IT (-1.17%), Materials (-0.41%) and Communications (-0.01%) the weakest links.

- Asian stocks brushed off news that China’s embattled property developer, Evergrande would be put into liquidation with $505bn in liabilities.

- Boss Energy Ltd (ASX: BOE) -4.48% was downgraded to a hold at Bells & Jefferies, they’re struggling with valuation after the sector has run hot. Still seems to MM that some consolidation is in order in the Uranium space and we’re best on the sidelines for now.

- Bapcor Ltd (ASX: BAP) +5.88% rallied on a 1H24 trading update that alleviated some concern around their recent performance. A huge trading range in the stock today, rallying 10% from the lows.

- Domino’s Pizza Enterprises Ltd (ASX: DMP) +1.06% edged up although a long way to go to recoup the ~30% decline from last week after they flagged concerning trends overseas. We have no interest.

- Orora Ltd (ASX: ORA) +2.99% is a stock we’ve flagged recently as having a great mix of defensive qualities, a path to decent earnings growth and a currently depressed valuation, others in the market started to appreciate those characteristics today.

- Perpetual Ltd (ASX: PPT) -2.06% was weak on more outflows, with clients pulling $4.3bn in the December quarter, though strong markets meant total AUM was up 1% to $213.9bn.

- Woolworths Group Ltd (ASX: WOW) -0.03% said they plan to write down the goodwill on their NZ business by NZ$1.6bn in a 1H24 trading update today, ahead of results on the 21st Feb. They also guided to Ebit growth of 2.8-3.8% which has them coming in a whisker below consensus of $1.7bn.

- Gold Road Resources Ltd (ASX: GOR) -18.42% was hit after they lowered production guidance.

- Bowen Coking Coal Ltd (ASX: BCB) -9.46% downgraded production guidance but showed an improvement operationally, a new CEO to take the helm.

- Iron ore was up 1.42% in Asia

- Asian stocks were mostly solid, Hong Kong added 0.59%, Japan was up +0.95% though China dipped -0.3%.

- US Futures are down a touch.

- Companies we own reporting in the US this week: 30th January / tomorrow sees HCA Healthcare Inc (NYSE: HCA) & Microsoft Corp (NASDAQ: MSFT) out while Apple Inc (NASDAQ: AAPL) and Brunswick Corporation (NYSE: BC) report on the 1st February,

Market Matters Australian Reporting Calendar – Click to download a spreadsheet HERE or a PDF document HERE

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Bapcor (BAP) $5.58

BAP +5.88%: the auto parts business was out with a 1H trading update today, investors initially took the news as a negative however shares battled back strongly, rallying 10% from lows.

They expect to report Revenue growth of 2%, EBITDA to fall 1-3% and Profit down 13-15% at the first half result on February 23 with strong Trade & Wholesale performance offsetting weaker Retail.

Bapcor already poured cold water on performance for the first 6 months of the year at the AGM in October so today’s update was largely as expected. Cost-saving initiatives are expected to improve profit by $2m in the 2H, and their transformation program could add a further $10m.

The papers have also reported some potential interest in the business from private equity, likely another reason for the share price reaction.

Bapcor (BAP)

Calix (CXL) $1.825

CXL -22.01%: the green industrial technology company fell to 3-year lows today following news a project partner had halted progress on the implementation of Calix’s kiln technology.

One of the world’s largest cement companies, Heidelberg, is shutting down its Hanover facility that was also planned as the site of Leilac-2, citing weak cement sales in Germany.

While Heidelberg is committed to finding another appropriate site for Leilac-2, and the decision was made before the construction of the kiln, saving substantial write-offs, it does further delay revenue Calix was banking on as they work on commercializing several products.

Calix (CXL)

Bowen Coking Coal (BCB) $0.067

BCB -9.46%: the junior coal miner provided a 2Q production update today alongside announcing the current CFO will take over the CEO role following Mark Ruston’s resignation less than 12 months in the role.

Production wise Bowen managed a solid quarter despite facing significant rainfall events. Coal production was up 22.6% on the prior quarter, and realised prices jumped 47%, though coal sales slipped on rainfall and rail capacity.

Given the slightly softer finish to the quarter, the company downgraded guidance for the year towards the lower end of their prior guidance range. Strong coal prices have vastly improved the company’s balance sheet, things look a little easier for the company from here after a period of pain.

Bowen Coking Coal (BCB)

Broker Moves

- Regis Resources Ltd (ASX: RRL) Cut to Sell at UBS; PT A$1.90

- Car Group Ltd (ASX: CAR) Cut to Neutral at Citigroup Inc (NYSE: C); PT A$34.30

- Boss Energy Cut to Speculative Hold at Bell Potter; PT A$6.41

- Mineral Resources Ltd (ASX: MIN) Raised to Buy at CLSA; PT A$72.50

- Objective Corporation Ltd (ASX: OCL) Cut to Neutral at Goldman Sachs Group Inc (NYSE: GS); PT A$13.80

- Dicker Data Ltd (ASX: DDR) Cut to Sell at Goldman; PT A$10.20

- Woodside Energy Group Ltd (ASX: WDS) Raised to Add at Morgans Financial Limited

- South32 Ltd (ASX: S32) Cut to Hold at HSBC; PT A$4.10

- Paladin Energy Ltd (ASX: PDN) Raised to Buy at Citi; PT A$1.45

- Resmed CDI (ASX: RMD) GDRs Cut to Accumulate at CLSA; PT A$31.25

- IPH Ltd (ASX: IPH) Raised to Overweight at Jarden Securities; PT A$9.65

- Santos Ltd (ASX: STO) Raised to Overweight at Jarden Securities; PT A$8.05

- Wesfarmers Ltd (ASX: WES) Cut to Neutral at Macquarie Group Ltd (ASX: MQG); PT A$56.30

- Coronado Global Resources Inc (ASX: CRN) GDRs Cut to Hold at Ord Minnett; PT A$1.80

- Boss Energy Cut to Hold at Jefferies; PT A$5.20

Movers & Losers