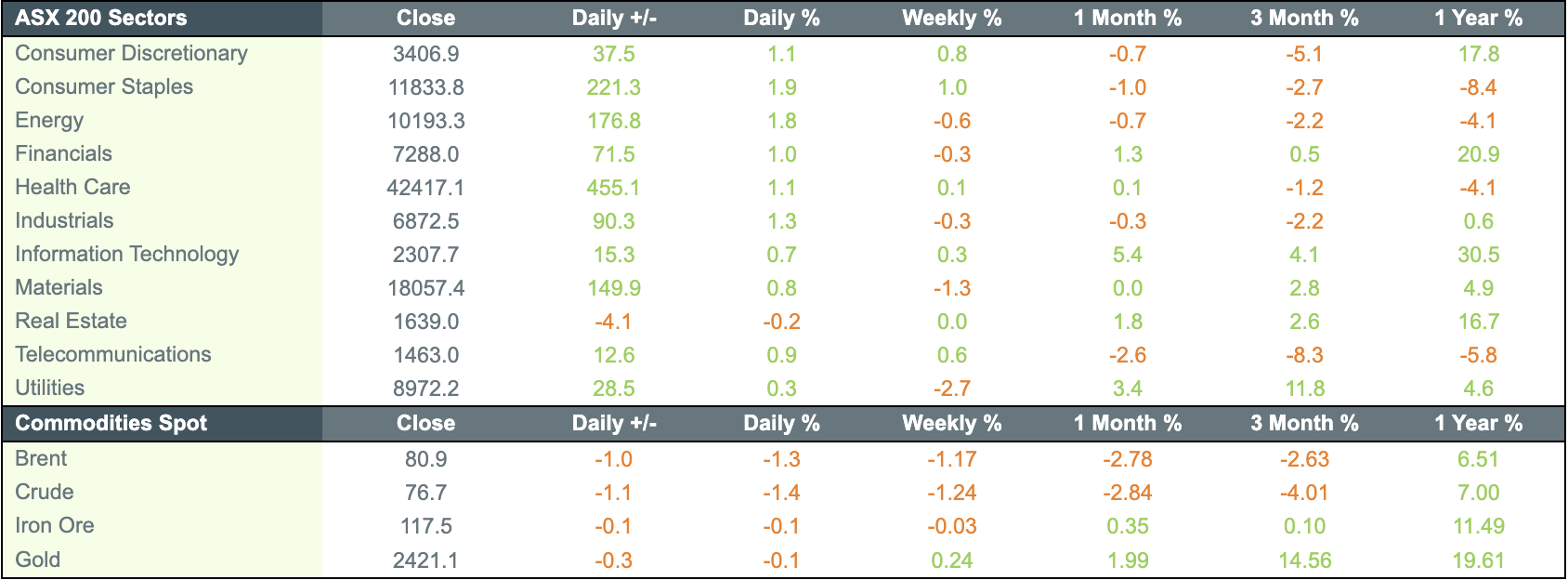

Australian shares ended a three-day losing streak on Friday, with the S&P/ASX 200 (INDEXASX: XJO) climbing 1 per cent, or 73.5 points, to 7701.7 points. Despite this gain, the ASX 200 benchmark index finished the week down 0.3 per cent as investors reacted to higher-than-expected inflation data for April, which delayed the expected timeline for interest rate cuts by the Reserve Bank.

Editor’s note: the ASX 200 finished Monday higher. This ASX 200 report was written Monday morning.

Guzman and Gomez to IPO on the ASX

All sectors finished higher except for the interest rate-sensitive property sector, which dipped 0.2 per cent.

Consumer staples emerged as the best-performing sector, with Treasury Wine Estates (ASX: TWE) rising 2.8 per cent to $11.33, Bega Cheese (ASX: BGA) surging 6.2 per cent to $4.46, and Woolworths (ASX: WOW) climbing 2 per cent to $31.60.

The big four banks also saw gains, with Commonwealth Bank (ASX: CBA) up 1.3 per cent to $119.54, and ANZ Banking Group (ASX: ANZ) rising 1.2 per cent to $28.25. Westpac (ASX: WBC) and National Australia Bank (ASX: NAB) experienced smaller increases of less than 1 per cent.

Telix Pharmaceuticals led the gains on the benchmark index, jumping 15.3 per cent to $18.15 after a positive broker note and favourable clinical trial results, marking a 1380 per cent increase over five years to a $5.4 billion valuation. Additionally, Guzman y Gomez announced plans to list on the ASX in June with an enterprise valuation of 32.5 times its forecast EBITDA of $59.9 million for the financial year 2025.

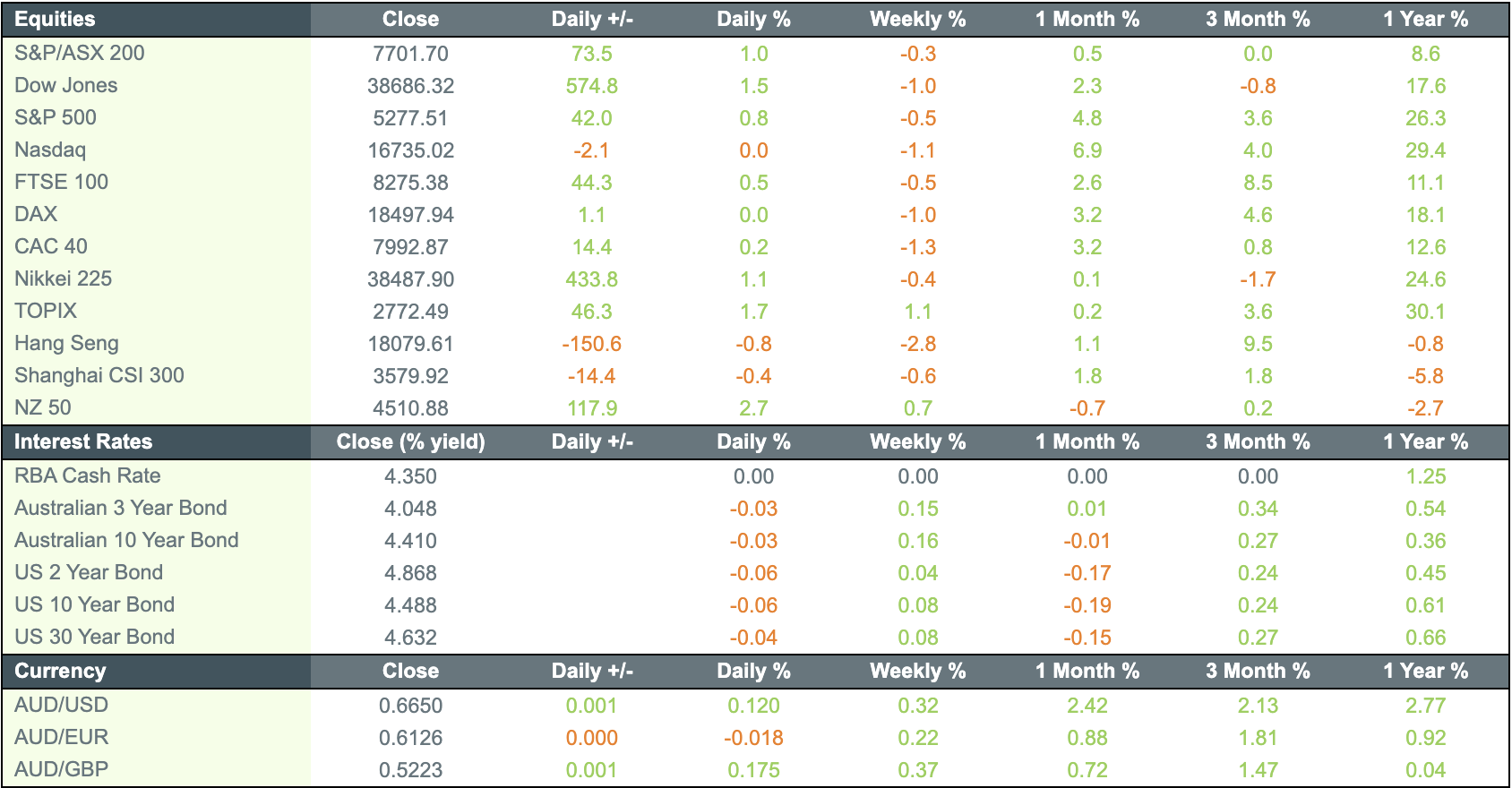

Mixed results across US indices, Salesforce rebounds, Dell plummets

The S&P 500 closed 0.8 per cent higher on Friday, with the Dow Jones Industrial Average surging by 575 points, buoyed by significant gains in Salesforce and UnitedHealth. Meanwhile, the Nasdaq finished relatively unchanged.

Investors closely monitored the Federal Reserve’s potential rate cuts, especially after Personal Consumption Expenditures (PCE) inflation figures met expectations. On the corporate front, UnitedHealth shares rose 2.9 per cent, while Salesforce rebounded 7.5 per cent following a 20 per cent drop the previous day due to missed revenue and sales growth targets, providing a substantial lift to the Dow.

Gap shares soared 28.6 per cent after first-quarter earnings exceeded estimates, and Nordstrom climbed 5 per cent on strong quarterly sales growth. In contrast, Dell Technologies plummeted 17.9 per cent due to a lower-than-expected AI server backlog, despite posting robust earnings. Costco dipped 0.8 per cent, despite better-than-expected earnings and revenue.