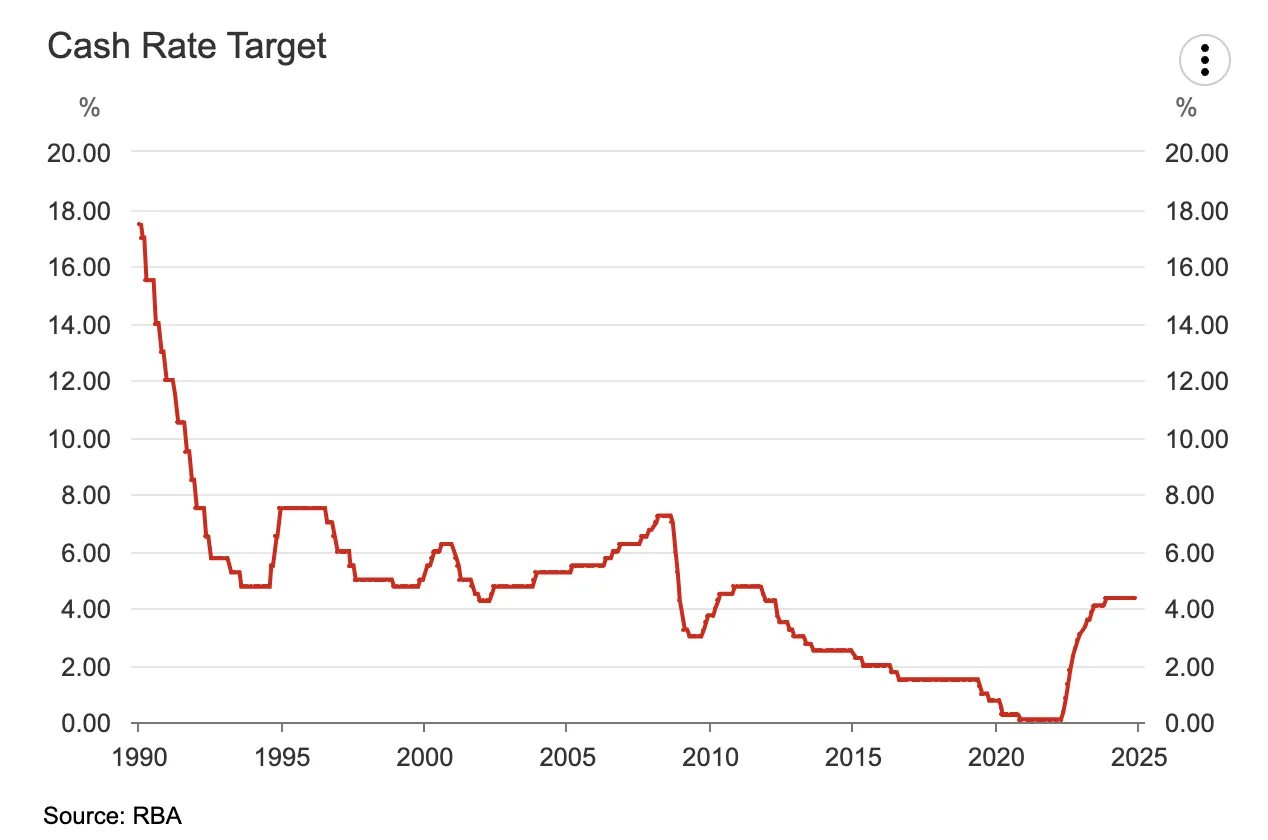

The Reserve Bank of Australia (RBA) today made the right call – the RBA kept interest rates on hold at 4.35%.

That means, anyone with a mortgage will probably see their interest rate kept steady at around 4.35% + 2% (typical bank profit margin) = 6.35%.

This article explains (in under 500 words) why the RBA made the right call today.

RBA interest rates

RBA made the right call

Today’s RBA call was a big one because virtually everyone else is the world is currently experiencing declining interest rates.

Naturally, news of an RBA hold decision meant everyone from the joyeful property apocalypse brigade over on Twitter (sorry, X) to the Martin Place Pinstrippers on LinkedIn took an opportunity to mansplain why the RBA got it wrong. Again.

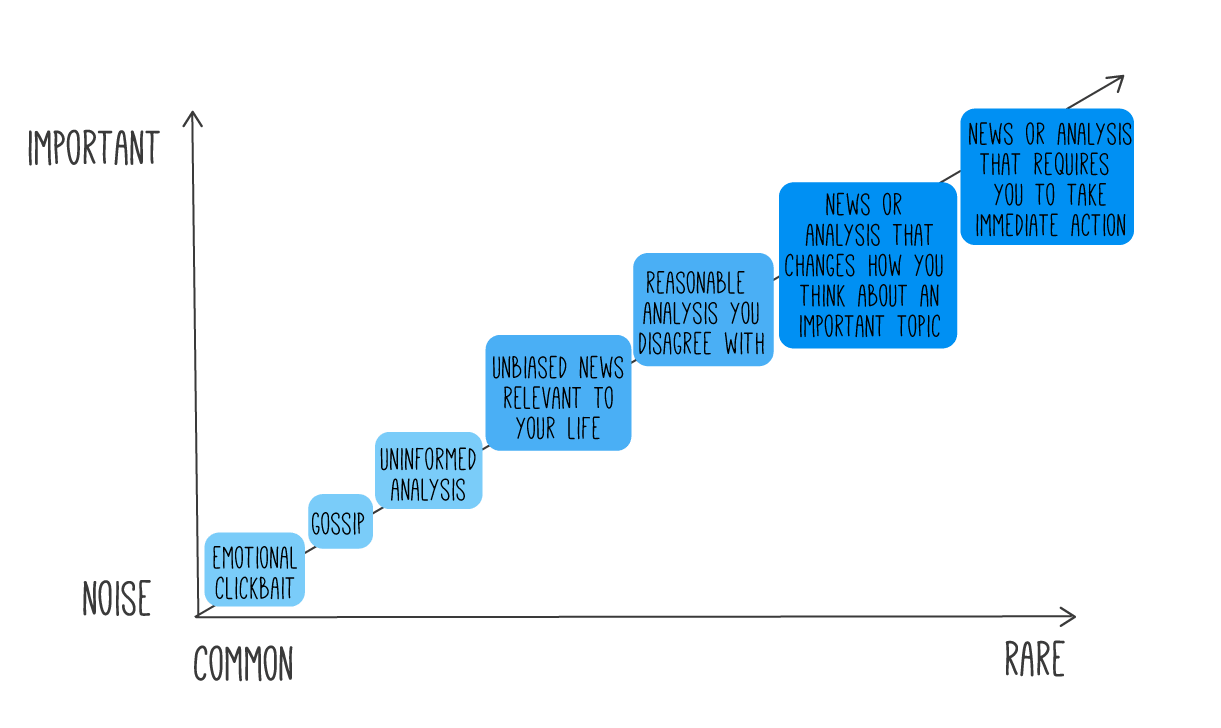

Heck, even the most honourable “news websites” – such as news.com.au – took a spell from writing articles like “tell me, b**ch’: Wild rant at Melbourne Cup” and “Sign outside Bunnings proves sad reality” to focus on the hardest hitting news: “‘Stupidity’: Proof we need major RBA ‘rule’”.

But here’s the rub: none of them wrote anything worth reading.

(Okay, I must admit – I’m a sucker for Bunnings gossip.)

As usual, today’s RBA announcement will be forgotten almost as quickly as the latest saga involving Prince Harry.

And investors will be wise to treat RBA decision day just like any other. Why?

No-one will ever know exactly what information, discussions, reports and analysis went into making the RBA decision today. And frankly, one interest rate decision should never break your investment strategy or financial situation.

In writing this update, I was reflecting on when Ronald Wayne sold his 10% stake in Apple Computer in 1976 (now worth over $500 billion) he said, ‘I made the best decision I could, given the information I had at the time’.

A decision is only ever as good as the information that goes into making it. And no-one will know exactly which information the RBA used to inform its decision today.

Should we up on forecasting?

Instead of being specifically correct, I would argue all of us should only try to be generally right:

- Avoid a Woolworths (ASX: WOW) valuation to 2 decimal places – instead, get a range for ‘fair value’

- Avoid a specific call on the November 2024 RBA rates decision – but rather position yourself so it is ‘heads, I win on my bond position; tales, I don’t win as much’, and

- Rather than ‘should I hedge my Australian dollar exposure?’, instead think ‘how much is reasonable to currency hedge’?

While Charlie Munger often joked that commonsense is uncommon, if you truly plan on adopting a long-term commonsense approach to investing, you must actively avoid the noisiest opinions and choose your information source wisely.

I keep a running ‘score’ of all commentators and news outlets for their quality, so I know who and which news sites will lead my finances astray for their own gain.

If you do something like this, your life – and your returns – will finish the race miles ahead. To see the exact ETFs we own, including our chosen bond and cash ETFs, click here. Or ask me anything you like in the free Rask Community.

(Psst. not to get too technical but the yield curve on Australian bonds is pointing investors towards at least 2 x 0.25% cuts by November 2025. We’ve held our portfolios in long duration bond positions for over a year and nothing said today will change that.)