After we all took a moment to breath easy yesterday with the S&P/ASX 200 (ASX:XJO) p 4.5% for the day, it appears we’re now back to business as usual with the S&P 500 down 3.7% and the Nasdaq 100 down 4.7%.

Yesterday’s momentum was taken away by the Trump administration confirming the rate on Chinese imports would be “at least 145%”.

Here’s what we saw:

- S&P 500 = -3.7%

- Nasdaq 100 = -4.7%

- Aussie dollar = +1.4% to US$62.40

- Iron ore = +2.6% to US$97.25 per tonne

- ASX SPI indicates a 1.9% decrease

Keeping our eye on BHP, RIO and the buoyant consumer staples

Materials companies such as BHP Limited (ASX:BHP) and Rio Tinto Limited (ASX: RIO) really have been shunted around by the words coming out of the White House and we expect today to be no different. Remember, their number-one customer is China.

We’ll be watching to see whether the likes of Woolworths Group Limited (ASX: WOW), Coles Group (ASX: COL), and Telstra Limited (ASX: TLS) can continue to be seen as resilient plays for Australian investors, or whether hopes of a short-lived trade war are fading, with sentiment now impacting even our most defensive businesses.

Owen’s pick for best business model soared

In a recent episode of the Australian Investors Podcast, Owen Rask, our Chief Investment Officer, choose Australian funds management business, Pinnacle Investment Management Group (ASX: PNI) as his pick for best business model. Yesterday Pinnacle shot up 12% – obviously off the back of Owen’s weighty praise.

Why is Pinnacle a great business model?

Pinnacle acts as a sales, marketing and general administration service for funds management teams. Pinnacle takes an ownership stake in exceptional funds management teams and relieves them from the non-funds management duties allowing the team to focus on what they do best. For this, Pinnacle shares in the management and performance fees of these funds. And, just like you would diversify your own portfolio Pinnacle diversifies theirs. With funds covering Australian large and small caps, global shares, fixed income etc.

We’d love to see this business cheaper. When we have the time we would love to dive into Navigator Global Investments Limited (ASX:NGI), a similar business model taking stakes in alternative asset managers around the world.

Monash IVF issues continue

Monash IVF (ASX: MVF) finds itself in the news again – the current situation is difficult for everyone involved and I hope they all get the support they need.

Monash has been plagued by controversies since its listing on the ASX. Birthed out of private equity (I am as shocked as you are), Monash came on to the market with a lot of promise, this is a business that truly should deliver win/wins.

But over the years it’s failed to deliver with a well-documented poor culture which includes this letter to the board from senior staff.

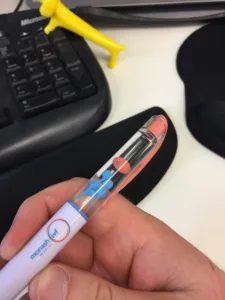

In 2016 I interviewed the CEO at the time and he gave me this pen. I wonder if there were signs of any cultural problems?

My conspiracy theory of the day: Green on the green

The US Masters started today.

Trump is an avid golf fan.

Do you think, somewhere in the back of his mind he said to himself:

“If I pause these tariffs for 90 days as a few people have suggested, I might get a bit of peace and quiet to watch the Masters”?

We can’t rule it out.

Enjoy your Friday, don’t be distracted by the noise of the market and don’t get weighed down by the deflating feeling of a market pull-back after yesterdays hope. Stick to your plan, get support from like minded investors in the Rask Community – they have truly been great or use the chat function to talk with me or pop over to Rask Invest.