Is it better to pay down your mortgage, use an offset account or invest in Australian shares via the share market? With the Rask network now including well over 200,000 Australians, the mortgage or shares question is one I get often.

Pay off the mortgage or invest in shares?

When it comes to managing our household finances, deciding whether to invest in Australian shares (e.g. through a low-cost ETF like VAS, IOZ or A200) or keep money in a mortgage offset account (pay off the mortgage) can be tricky.

Making an informed decision is crucial since this aspect of your life (your mortgage) is probably one of the most important for your long-term wealth creation.

However, it’s not as black-and-white as we think. To properly understand this financial dilemma, we have to take into account a few ‘softer’ elements to make the right decision. These include our:

- Risk profile

- Financial literacy, and

- Time horizon

In this Rask Guide, I’ll quickly explore the key ideas behind both strategies – paying down the mortgage or investing in shares/ETFs – including the tax consequences, behavioural aspects, and key considerations to help you make the best choice.

But please remember two things:

- I don’t know your situation or needs – so if you’re confused, find a good financial planner, and

- Jump over into our free online investing community to tell me where I went wrong or what you think (or to say g’day – our team loves hearing from you)

Paying off the mortgage or investing in shares: the basics

When it comes to deciding whether to pay off the mortgage or invest in shares, there are some fundamental things you should know. Many people miss these key points or disagree with me due to a ‘belief’, rather than focus on the facts.

Australian shares can grow and pay tax-effective dividends

Over the past 30, 50 or 100+ years, it’s fair to say the Australian share market has probably been the world’s best investment. Yes, even better than property (excluding the impact of gearing/debt).

The Australian share market, which is usually tracked on the evening news through ‘indices’ like the ASX 200 (top 200 Australian shares) or All Ordinaries (which has been going on for many decades), has been a top performer. Australia really is the lucky country when it comes to shares.

Importantly, the Australian share market offers the potential for high returns over time (e.g. 10+ years) but it comes with risks in the short run.

Warren Buffett: “The longer you hold stocks the less risky they become.”

Historically, the ASX has provided significant growth and tax effective dividend income over the long term (10+ years).

Key indices like the ASX 200 and All Ordinaries give a snapshot of market performance, helping investors track trends and make informed decisions.

However, you need to be really careful about what you hear or see on the news and what you’re basing your decision against, especially if you plan on making a decision on whether to invest in shares or pay off the mortgage.

The ‘XJO’ version of the ASX 200 and All Ords index – the two popular ways to show the Aussie stock market – do not include the impact of dividends paid on the shares, as they simply track the ‘share prices‘. This would be like tracking a savings account… without the interest.

In addition, those indices don’t take into account ATO franking credits, which are a type of tax ‘credit’ that is unique to Australia (interestingly, some analysts say it’s also one of the reasons why our stock market has performed the best over the past 100 years!).

What are franking credits?

In basic terms, many companies on the Australian share market pay tax (e.g. at 30%), so if you’re eligible you hold those companies/shares, you may receive a tax ‘credit’ equivalent to 30% of the cash dividends you receive in your bank account. Our Tax on Shares and ETFs guide goes into depth about how tax on shares works.

Benefits of paying off the mortgage

An offset account is a special type of bank account that’s linked to your mortgage. If you don’t know about them, please go and check you have one by contacting your bank, or you can use my chosen mortgage broker to get one on a new loan.

An offset account will help you reduce the interest paid on your loan by offsetting the loan balance with the offset account balance. For example, if you have $50,000 sitting in a linked offset account and a $500,000 mortgage, you will pay interest on only $450,000 ($500k – $50k = $450k).

Another (older style) option is paying down the mortgage directly (i.e. transferring money directly into the loan account), which reduces the principal amount you owe, leading to lower interest over time.

Both the offset and direct payment methods offer benefits – namely lower interest bills, faster loan repayment period, financial independence, and more equity in the home (which you can use to redraw and invest as tax-deductible debt).

In my opinion, for most people, using an offset account is a far better option compared to paying off a mortgage because it has the same interest saving impact but you can keep the flexibility of having cash in the bank.

Let’s now tackle the first plot twist…

Tax impacts of investing in Australian shares

To understand your decision better, here’s a super quick tax primer…

Investing in Australian shares involves capital gains tax (CGT) on the profits made when you sell.

For example, you buy BHP Group (ASX: BHP) shares for $10 and sell them at $25 – that’s a $15 capital gain (25 – 10 = 15). In Australia, the capital gain is cut in half (i.e. $7.50) if you hold the investment for a year or more. This is known as the capital gains tax (CGT) discount. So, realistically, if you’re deciding to invest for 3, 5, 10 or 20 years (like me), you won’t pay this tax every year.

In other words, tax on the gain can be deferred until you sell. As obvious as this sounds, this topic is something basically no one talks about when discussing whether to invest or pay off a mortgage. Why? Because it’s hard to explain and calculate in an article. But it’s how things really work, so we need to think about it.

Dividends received on your shares may also be subject to income tax. For example, if you get $100 of dividends this month, you need to add that to your tax bill for the year. So far, so good…

However… franking credits you receive can offset your income tax bill, thus reducing the overall tax you pay.

(This is where people’s eyes start to glaze over… but please stay with me for a couple of minutes…)

It might sound confusing but understanding the tax implications of investing, if only at a high level, is vital for optimising investment returns and wealth creation. Don’t let the investing industry fool you into thinking it doesn’t matter!

Most people seem to forget that 40% or more of the long-term returns from Australian shares can come from dividends. Pay close attention.

So obviously when we’re weighing up paying off the mortgage or investing in shares, we should probably use the most realistic number – the one which includes dividends and the impact of tax.

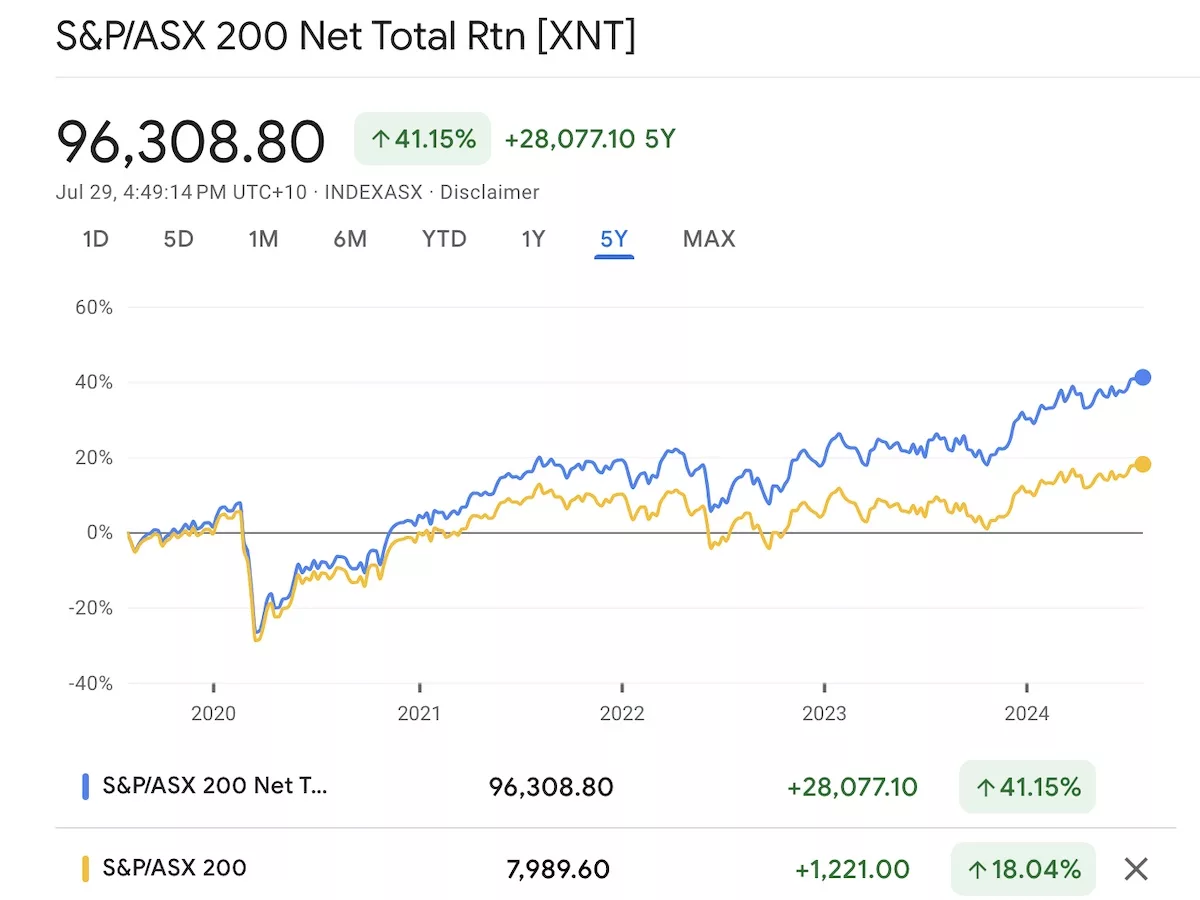

To make life a little easier, you can use Google to track the share price plus dividend performance of the Australian share market using the ASX 200 Net Total Return Index (ASX: XNT) versus the one the media likes to quote in their news headlines – the ASX 200 (ASX: XJO).

Here’s the difference dividends can make…

As you can see in the chart above, over just 5 years of returns, the dividends have made up more than half of the Australian share market return. Go back even further and it gets even more concerning to think that the media forgets these tax-effective dividends are included…

In any case, let’s do a worked example so we can nail it home…

For round figures, let’s assume the stock market returned 10%, with 4% of the return coming from dividends.

On average, let’s also assume that 3/4 of Australian companies pay dividends with franking credits. That means 3% of our total 10% return comes with fully franked credits.

Assuming the standard corporate tax rate of 30%, that little 3% return grows to ~4.3% after the positive impact of the tax credits.

Now we have:

- 6% capital growth

- 1% in unfranked dividend return, plus

- 4.3% of dividends with franking credits added back (“grossed up” dividends).

All of a sudden, that 10% return with some franking turns has changed into an 11.3% total return – before we pay the tax man.

Note: for the rest of this article, I’ve been conservative and assumed the 6% capital gain is being taxed in full but realistically if you’re a long-term investor, at most it’ll get taxed at 50% (the CGT discounted rate), since you’re probably going to hold the shares or ETFs for many years into the future.

Tax on offset accounts

Interest saved from your mortgage (or offset account) is not taxable because technically it’s not a ‘return’ but a saving (i.e. you save on interest). Some people take this to mean that it provides a clear tax advantage and ‘guaranteed return’. Therefore, they think the ‘pay off the mortgage or invest in shares’ debate is done and dusted.

Not so fast…

We need to compare apples to apples. That is, we need to compare the tax-adjusted amount from shares with the tax-adjusted amount from the offset account.

The Moneysmart.gov.au website provides a free mortgage calculator to help you understand the benefits of paying back a mortgage sooner.

Interestingly, it also shows homeowners the average mortgage interest rate in Australia. At the time of writing this, the average mortgage interest rate is 6.22%.

The math of mortgage repayment & investing

To calculate the impact of investing or making an extra mortgage repayment, you have to assume a tax rate. Let’s assume we pay tax at a rate of 30%.

An offset account earning 6.22% would have a tax-adjusted required return of [6.22/(1-0.3)] of 8.88%.

Meaning, we would have to make an 8.88% return in 12 months from an investment, to meet the return offered by our mortgage – in tax-adjusted terms.

Now, you’re probably thinking, well, the return from shares is higher than that, right? You would be correct. Shares have averaged slightly more than that.

Over long periods of time (e.g. 10+ years), Australian shares have almost always returned more than an offset account. For example, in the 54 years between January 1970 and June 2024, Australian shares returned 9.4% per year, on average.

Keep in mind, I said on average.

At risk of sounding like another Leonardo DiCaprio movie no one understands, or gets to the end of, this is where the second plot twist comes in.

(Sorry Leo, I could handle Inception’s twists and turns but to then make us sit through 3.5 hours of Killers of The Flower Moon…)

Behavioural aspects

Mike Tyson famously said everyone has a plan until they get punched in the face.

Wall Street prefers to sound smart and quote a Polish-American scientist and philosopher Alfred Korzybski who once said, “The map is not the territory.”

Meanwhile, international best-selling author Morgan Housel says, try to be reasonable rather than rational.

And I’m here to say, everything looks good… in a spreadsheet.

Basically, we’re all saying the same thing – finance is more than numbers.

There are behavioural aspects of what we do with money that we need to appreciate. Even if we can’t quantify them with precision.

Investing in the share market – a wall of worry

Market volatility, or ‘the random ups and downs’, can evoke seriously strong emotional reactions that will obviously influence our investment decisions. There’s a saying in investing that, everyone is a high-growth investor… until the next market crash.

While the long-term charts of Australian shares are simply brilliant – probably the best that planet Earth has ever seen – zoom in to a one-year time horizon and you’re left with a 20% chance it goes backwards.

From the year 1900 to 2024 (124 years), the Australian share market returned an average of 13% per year – but went backwards 1-in-5 years.

And the reasons they fell? No one knew for sure before it happened. It just happened!

And it’s often years later when people are finally able to figure out what happened.

Although, in some cases – like the single-day, 25% fall in Australian shares on 19 October 1987 – no-one has ever worked it out.

Long-term thinking and a solid understanding of market behaviour can help us identify and manage these emotions, but assessing your risk tolerance and financial literacy is key when considering whether to navigate the share market or pay off your mortgage.

The behavioural element is why I set up Rask Invest: to invest for people over decades, by providing a ‘barrier’ between our investors and bad mistakes that happen during a market correction. It’s not about what we do now, but what we do when things turn bad.

Bottom line: the stock market goes up over time and probably beats paying off a mortgage. But on the way up it climbs a wall of worry, where mistakes are severe and common. Therefore, it’s reasonable to assume that investing in shares requires a long-term focus, a moderate-to-high risk profile and a genuine desire to grow wealthy.

Paying off the mortgage – it passes the sleep-at-night test

At the other end of the risk spectrum, we have savings accounts.

Offset accounts, while not necessarily guaranteed, are a great place to park extra savings.

(Psst. offset accounts are far better than a normal savings account or term deposit because you pay tax on those but you won’t on an offset account.)

While there may be some risk putting your money in a regulated bank, in the short term it’s a very safe thing to do compared to shares. Just keep in mind that having money in the bank is not always enough to beat inflation.

Bottom line: reducing debt provides comfort and empowerment, making you feel in control of your finances. Even if it’s not the best way to grow wealthy it can be the best for you.

Can I use an offset account now, then switch to shares?

A common strategy people think they can use is switching the offset money into shares when interest rates fall. For example, if interest rates are 6% now but I expect them to be 2% in three years, I could just take advantage of paying off my mortgage now and then switch across later, right?

Right?

Right?!

No.

It doesn’t work like that. At least, not normally. In fact, it can go the other way.

You see, if interest rates are expected to fall, share price rise now. The stock market is what we call ‘forward looking’, in that the prices of shares tend to reflect the most commonly agreed-upon ‘story’ of the future.

For example, let’s say some breaking news about inflation comes out today. All of a sudden, inflation is lower than everyone expected. And because of that most investors think ‘Wow, interest rates might fall in 12 months!’ In that case, the share prices of companies/shares should go up today, not in 12 months. Meanwhile, you’re still stuck paying 6% for the next year while shares are climbing faster in anticipation of falling interest rates being good for businesses and investors, and bad for savers.

Bottom line: this strategy doesn’t work because share market participants look to the future, not the past or present, to set their valuations.

Can I stay in cash for the next market crash, then buy in?

If I had a dollar…

No, if I had 0.01 cents for every time someone told me ‘the market is going to crash’ or ‘it’s expensive’ or ‘I heard on the…’ I would be retired by now, living on an island without an offset or a mortgage, and sucking down mojitos paid for by more franking credits than the ATO has ever seen.

While we could review copious amounts of literature that shows market timing is impossible and doesn’t work, after seeing and hearing people use all kinds of mumbo jumbo over 10+ years, I’ve realised one thing about humans and the stock market…

Bottom line: If you aren’t brave enough to invest now while the going is good, you sure as hell ain’t going to be brave enough to invest when the stock market has just plummeted, doom is in the news and prices are fantastic.

And heck, even if you do somehow pick the absolute bottom of the market every single year for the next 30 years, studies show you barely do any better than people who just buy on the same day every month. Just get on it with and invest. You’ll probably lose more money by missing out on the gains in shares than by waiting in cash.

Investing in a diversified way

Another question I get – a lot – is ‘should I invest a lump sum or break it up over time?’

The answer is much the same as the ‘offset v shares’ debate because the answer is – it depends on your long-term goals, balanced against your risk profile (short term uncertainty).

However, it’s worth mentioning briefly here because, in theory, most of us don’t just buy shares or hold cash in an offset.

We should always hold a diversified portfolio of Aussie shares, global shares, bonds, cash, term deposits and property. And most of us know that when those are combined together, in the right way, the returns are drastically ‘smoothed out’ over time.

Why?

Because when bonds do badly, oftentimes cash and shares do better. And when shares do badly, bonds often do better.

It’s called diversification, and it’s exactly how I invest with Rask Invest. In this way, I feel like I’m much more comfortable investing a lot of money upfront rather than using just shares or just an offset.

Bottom line: People who truly understand the power of, and harness, diversification and maintain a healthy perspective on long-term wealth creation would almost always choose to invest regularly over time.

My summary on investing in shares or paying off the mortgage

So do you invest in shares, or pay off a mortgage? I think both have their benefits but both have their drawbacks. So I think the simple answer is: do both.

Broadly speaking, Australian shares are definitely better in terms of passive income and even long-term capital growth, after fees, costs, debt and headaches after taken into account. How do we know this? Because capitalism rewards great people and great companies for solving the world’s problems – that’s why companies exist in the first place.

But cash in the bank makes us sleep better. So don’t try to time the market by switching, getting fancy with maths, or timing your strategies. Do a bit of both and learn as you go.

Simply build an appropriately sized emergency fund, in one or more offset accounts, and invest the rest in a diversified portfolio. If you manage your cash position and invest wisely through a diversified portfolio, I reckon you can capture the best of both worlds – a high sleep-at-night score while compounding for long-term growth in shares. Our portfolios are a great starting point – even if you don’t invest with us, you can use our Rask Invest portfolios as a guide to what you should do.